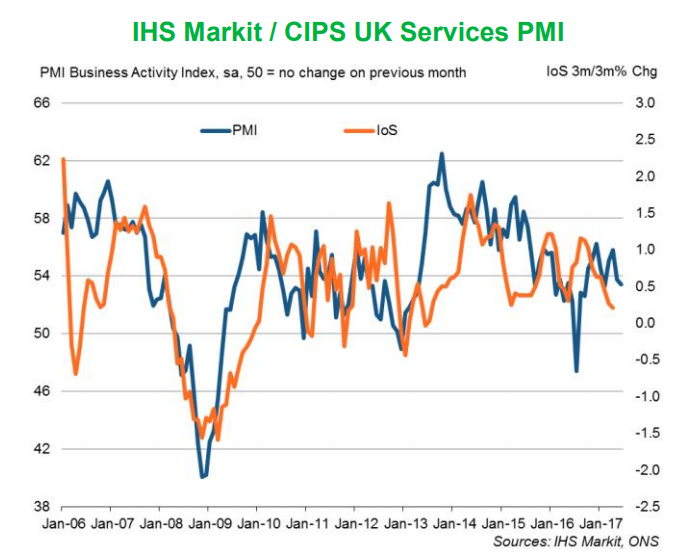

UK service sector growth slowed in June and business optimism hits lowest level since Brexit vote, survey data released earlier today by Markit/CIPS showed. Markit/CIPS UK Services Purchasing Managers' Index (PMI) fell to a 4-month low of 53.4 in June from 53.8 in May, missing forecast for 53.5 in a Reuters poll of economists. Data is likely to be a disappointment for hawks on the Bank of England (BoE) Monetary Policy Committee (MPC) who want to raise interest rates.

Today's data followed on from weaker manufacturing and construction surveys, completing a triple-whammy of disappointing PMI survey readings. The softer services PMI points to an already fragile economy struggling on account of uncertainties about the economic outlook and intensification of political uncertainty following the general election and commencement of Brexit negotiations.

Britain's economy barely grew in the first three months of the year dented by accelerating inflation, uncertainties caused in large part by the Brexit vote and slowing wage growth. Despite the slowdown, the three PMI surveys are running at levels that are historically consistent with GDP growing by around 0.4 percent in the second quarter.

Sharp and accelerated increase in average cost burdens at service sector companies. The overall rate of input price inflation was nonetheless still much slower than the peak seen in February. Service sector firms are optimistic overall that business activity will rise over the next 12 months. However, the degree of confidence fell markedly since May.

"Given the deterioration in the forward-looking indicators, such as business optimism and order book growth, the risks are tilted towards the economy slowing in the third quarter," said Chris Williamson, Chief Business Economist at IHS Markit.

Pound skids to one-week low as UK service sector growth slows in June, while the FTSE 100 turned negative in mid-morning trade after the latest PMI disappointment. The index recovered from lows and was trading at 7370 points up 13.52 points at 1135 GMT. Cable largely muted, trades a narrow range on the day. Daily cloud offers strong support at 1.2911, break below could see further drag.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns