Household finances in the United Kingdom remained stagnant during the month of October, while higher inflation expectations contributed towards the worst financial outlook in three years.

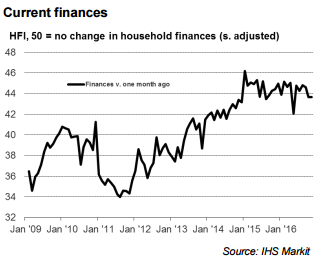

The degree of financial strain on UK households was unchanged in November, as shown by the seasonally adjusted Household Finance Index (HFI) holding steady at October’s reading of 43.7. Though subdued relative to the post-crisis trend (40.1), the latest figure signaled a stronger downturn than on average in 2016 (44.2).

Inflationary perceptions regarding both current and future living costs were at least partly behind financial pressures. Households’ current price perceptions surged to a near two-and-a-half year high. Stronger price pressures contributed to a downbeat outlook among UK households.

The seasonally adjusted index measuring expectations for finances in 12 months’ time dropped for a third straight month to a three-year low of 45.3 in November. Down from 47.9 in October, the index pointed to a negative financial outlook for the eighth month in succession.

The seasonally adjusted index measuring current inflation perceptions increased sharply to a 29- month high of 75.1 in November. The index rose a record 7.4 points since October (67.7). The index for expected living costs was also up in November, rising from 83.5 in October to 86.0 (the highest in over two years).

Meanwhile, with price pressures mounting, UK households appear to have grown more hawkish regarding the next move in the Bank of England base rate. Just 17 percent of respondents expect interest rates to fall further from their current low of 0.25 percent, down from 27 percent in October.

"UK households signalled the worst financial outlook for three years in November, with inflation expectations picking up to the highest since late- 2014," said Philip Leake, Economist, IHS Markit.

The FTSE 100 traded 0.16 percent lower at 6,782 by 10:30 GMT. While at 09:00 GMT, the FxWirePro's Hourly GBP Strength Index stood neutral at 22.23 (higher than +75 represents purely bullish trend). For more details, visit http://www.fxwirepro.com/currencyindex

The yield on the benchmark 10-year gilts, which moves inversely to its price, rose 4-1/2 basis points to 1.425 percent, the super-long 30-year bond yield jumped 4 basis points to 2.055 percent and the yield on short-term 2-year climbed 2 basis points to 0.224 percent by 10:30 GMT.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022