Today at 8:30 GMT, industrial and manufacturing production details would be released for month of March.

Why is it vital?

- Industrial production along with manufacturing is vital for any nation showing the pace of growth and recovery in country's industrial sector, which tends to benefit at times when domestic demand goes up along with export. Moreover industries and manufacturing are key components of country's GDP.

Past trends -

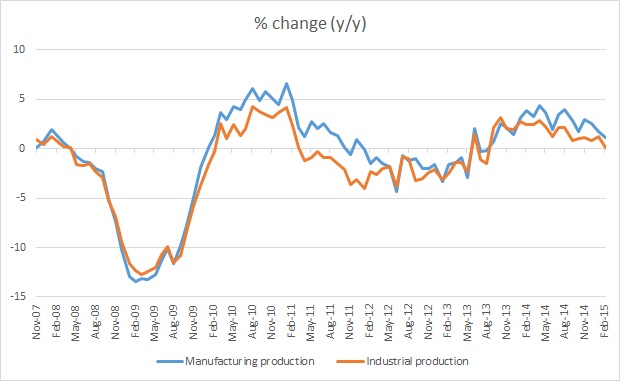

- UK industrial and manufacturing sector had gathered pace in 2013, however started losing pace by mid of 2014.

- In February industrial production grew only 0.1% y/y in April and manufacturing grew by 1.1% both well below the pace experienced during 2013 growth comeback.

Expectation today -

- Industrial production is expected to grow at 0.2% y/y in March and manufacturing production to grow by 1% in March on yearly basis.

Impact -

- Pound is trading around 1.559, struggling to decisively break above 1.56 area of psychological resistance.

- Weaker than expected data would provide a blow to pound bulls, however dips buying might lead the pair to recover lost grounds. On other hand stronger data would favor the bulls who might push towards next level of resistance around 1.575.

- All in all, pound's bullish momentum won't subside easily for now.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?