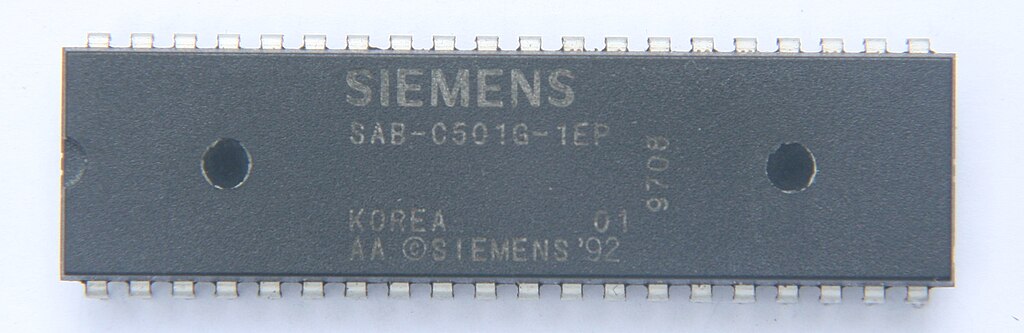

Siemens AG has reportedly received a notice from the U.S. government confirming the removal of export restrictions on its chip design software for use in China, according to Bloomberg News. The decision marks a notable shift in U.S. trade policy amid ongoing tensions with China over access to advanced semiconductor technologies.

The initial export controls, introduced to curb China's development of cutting-edge chips, had affected companies like Siemens that supply essential electronic design automation (EDA) tools. These tools are crucial for developing semiconductors used in a wide range of industries, from telecommunications to automotive technology.

The lifting of restrictions could offer Siemens renewed access to a key market and potentially unlock business opportunities in China’s rapidly growing tech sector. It also suggests the U.S. may be selectively easing certain rules to balance national security concerns with commercial interests.

While Washington continues to enforce broad chip export controls against China, the exemption granted to Siemens indicates a more nuanced regulatory approach. Analysts believe this could benefit both U.S.-allied tech firms and global supply chain dynamics, particularly in semiconductor design and manufacturing.

Siemens has not issued an official statement, and the U.S. Commerce Department has yet to comment on the matter. However, the development is likely to draw attention from the global semiconductor industry, which closely monitors policy changes that impact cross-border technology flows.

As chip demand continues to rise globally, especially for AI and advanced computing, easing some export restrictions could support innovation while maintaining oversight on sensitive technologies. This latest move may signal more targeted licensing decisions ahead as governments aim to support strategic industries without compromising security.

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Faith Leaders Arrested on Capitol Hill During Protest Against Trump Immigration Policies and ICE Funding

Faith Leaders Arrested on Capitol Hill During Protest Against Trump Immigration Policies and ICE Funding  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers

SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Illinois Joins WHO Global Outbreak Network After U.S. Exit, Following California’s Lead

Illinois Joins WHO Global Outbreak Network After U.S. Exit, Following California’s Lead  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Trump Proposes Two-Year Shutdown of Kennedy Center Amid Ongoing Turmoil

Trump Proposes Two-Year Shutdown of Kennedy Center Amid Ongoing Turmoil  Trump Administration Sued Over Suspension of Critical Hudson River Tunnel Funding

Trump Administration Sued Over Suspension of Critical Hudson River Tunnel Funding  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Trump Extends AGOA Trade Program for Africa Through 2026, Supporting Jobs and U.S.-Africa Trade

Trump Extends AGOA Trade Program for Africa Through 2026, Supporting Jobs and U.S.-Africa Trade  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Pentagon and Anthropic Clash Over AI Safeguards in National Security Use

Pentagon and Anthropic Clash Over AI Safeguards in National Security Use