The United States’ annual real gross domestic product (GDP) is expected to grow by 3 percent, while inflation (as measured by the US Urban Consumers CPI) to average around 2.5 percent, according to the latest report from DBS Group Research.

Surveys of businesses show both uncertainty about the outlook and the beginning of a trend of earnings projections being revised downward (starting with automobile manufacturers). But there are broader, still-supportive dynamics at play.

Last year’s tax cut will act as a shock absorber to potential downside from tariff wars, consumer spending is healthy, labour market is tight, fiscal stance is growth supportive, and trade, despite the poor headlines, is still robust, the report added.

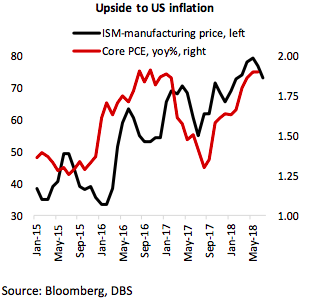

This path of economic data would not only ensure that the US Federal Reserve hikes two more times this year, but a continuation of the quarterly rate hikes can be expected next year as well. Inflation upside is likely (especially if trade wars continue and US-Iran conflict takes place), but so far the markers are modest, causing no heightening of concern for Fed policy.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed