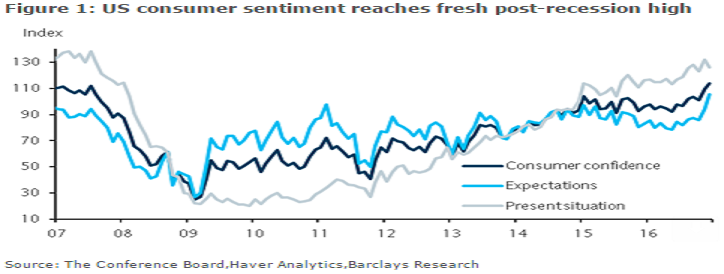

Consumer confidence in the United States remained upbeat during the month of December, jumping more than what markets had initially anticipated, in a signal that the moderation in the world’s largest economy will continue to boost household spending during the last quarter of this year.

The U.S. Conference Board’s index of consumer confidence rose to 113.7 in December, compared to 107.1 in November, extending the previous month’s gains. Although confidence was expected to improve further this month, the outturn was significantly higher than market expectations.

Consumer confidence reached a fresh post-recession high to 105.5, driven by a significant rise in consumer expectations, from previous 94.4. However, the present situation index, declined in December to 126.1, from previous 132.0.

The labor market differential, which measures the net share of consumers that saw employment as plentiful, eased lower to 4.4, compared to 6.6 previously, but it remains higher than the long-term average.

"On the whole, today’s report suggests that household confidence remains on a strong footing, and we view this as constructive for consumer spending in Q4," Barclays commented in its latest research report.

Meanwhile, the dollar index traded at 102.97, down -0.05 percent, while at 5:00GMT, the FxWirePro's Hourly Dollar Strength Index remained neutral at -12.95 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals