First quarter economic dockets from US has surprised to downside, pushing dollar to four month low and first rate hike expectation from US Federal Reserve to somewhere around January 2016, as measured from FED funds future.

However, weak growth in the first quarter doesn't mean that US growth is slowing, it could be more of seasonal pattern observed for last 25 years.

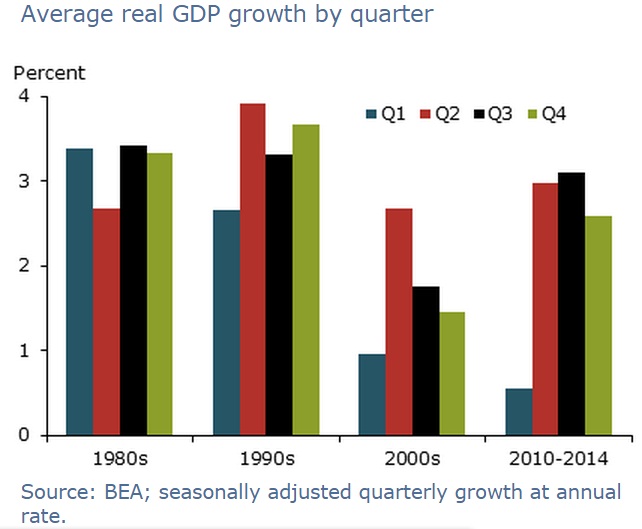

- Bureau of Economic Analysis's (BEA) GDP estimate for last 25 years has shown unusual seasonal pattern.

- During the 1990s, real GDP growth averaged 2.6% at an annual rate in the first quarter and 3.6% in the subsequent three quarters.

- In the 2000s, growth also averaged 1 percentage point lower in the first quarter than during the rest of the year.

- From 2000 to 2014, this seasonal discrepancy increased, and the first-quarter growth shortfall jumped to 2.3 percentage points on average from rest of the quarter.

This residual seasonality suggests that growth might rebound sharply in the next few quarters, which will subsequently give rise to rate hike bates if held true.

Focus for Dollar and treasuries now turn to second quarter data. Data from April to June becomes vital. US Federal Reserve is likely to wait the June meeting awaiting data confirmation from second quarter. Strong second quarter would make September meeting extremely vital.

Dollar index is currently trading at 94.91, up 0.8% today.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand