Home prices in the United States continued to witness steady gains during the month of October, remaining consistent with other home price indices. The indicator is expected to maintain the pace going into 2017.

US’ FHFA purchase-only House Price Index rose 0.4 percent m/m in October, a touch lower than consensus estimates of 0.5 percent, taking the y/y growth to 6.2 percent, around the same pace recorded at the turn of the year, data released by the Office of Federal Housing Enterprise Oversight (OFHEO) showed Thursday.

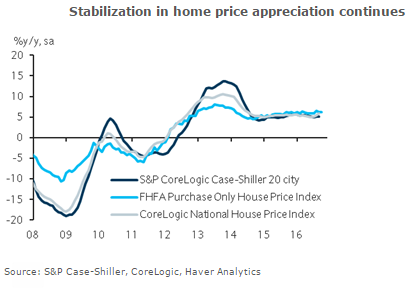

Prices gained in all the regional sub-components barring West N. Central fell -0.2 percent and East S. Central dropped -0.6 percent. The largest increases came from Mountain and New England. On the whole, today’s data are consistent with trends in other home price indices, which show annual home price appreciation stabilizing between 5-6 percent since 2015.

"We expect home prices to continue appreciating at a steady and modest pace for the rest of 2016 and 2017," Barclays Research said in its latest report.

Meanwhile, the dollar index traded at 103.01, down -0.08 percent, while at 5:00GMT, the FxWirePro's Hourly Dollar Strength Index remained neutral at -8.36 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure