Today's release of Consumer price index (CPI) numbers will be most watched by traders and investors. CPI is scheduled to be released at 12:30 GMT.

Why important?

- FED's dual mandate is price stability and maximum employment. However, Unemployment rate has now reached 5.5% in US, which is considered as very close to long term level. That leaves inflation to be most vital for first rate hike as well as path.

Past trends -

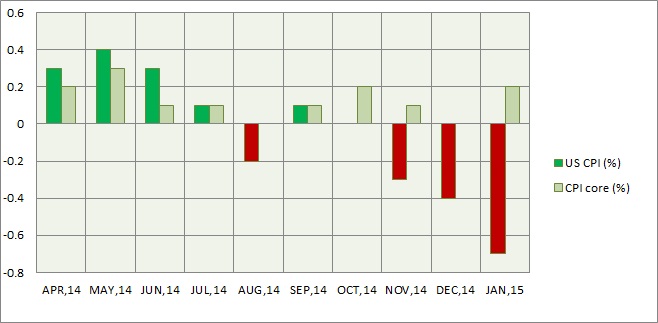

- CPI fell to negative territory in later half of 2014. In January CPI fell by -0.7%, mostly due to lower energy prices. CPI fell by -0.1% YoY.

- Core CPI so far has managed to keep its head above zero throughout last year. Core CPI grew by 0.2% in January and 1.6% YoY.

Expectation today -

- CPI is expected to rise by 0.2% mom and -0.1% yearly basis.

- Core CPI is expected to

remain subdued but positive growing 0.1%.

Impact -

- FOMC participants has reduced flashed their forecast for inflation in 2015 last week, however weaker data is not expected to bode well for US dollar and treasury yields.

- Market participants might push rate hike expectation further, should the core CPI fall below zero bound.

Dollar index is currently trading at 96.8, down 0.2% today.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary