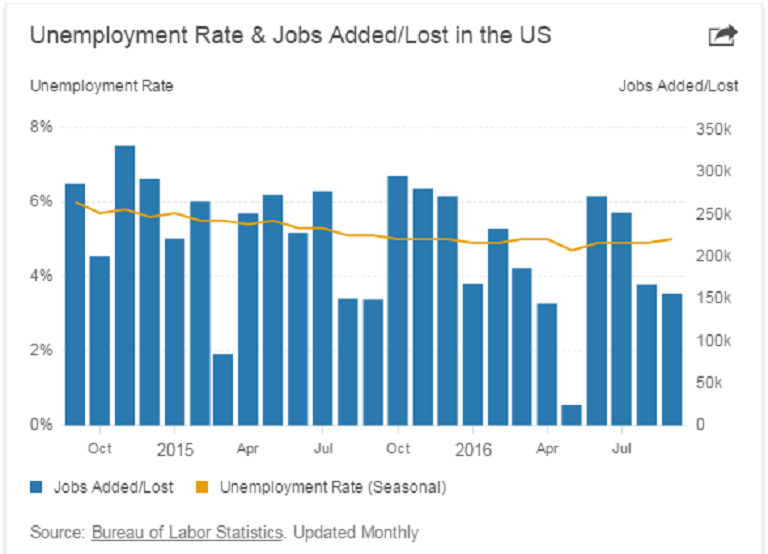

The United States rate of unemployment ticked modestly higher during the month of September, although the participation rate among the working age population soared to six-month high during the period, indicating that the country’s labor market has started to show signs of stabilization that could well support the case for an interest rate hike in December.

The U.S. jobless rate rose slightly to 5.0 percent in September, from 4.9 percent in August, defying expectations for no change, data released by the US Labor Department showed Friday. Also, the U.S. economy had a net gain of 156,000 jobs in September, the report showed.

Further, the report showed that 7.9 million Americans are out of work, a number that changed little in September. Another 5.9 million people are considered 'under-employed,' because are working part-time, but want full time work.

A positive report on the job market tends to help the incumbent political party, which is trying to convince voters that it has done a good job managing the economy. Bad economic news could help persuade voters that it is time for a change of leadership.

A mixed bag of labor market data increased complications for the United States Federal Reserve, which has kept rates on hold for a sufficient amount of time, waiting to witness an improvement in the economy. However, the rise in participation rate has more than offset the marginal rise in unemployment, strengthening the case for a rate hike in December.

Meanwhile, employers continued to add to payrolls in September as record openings drew more Americans into the workforce and most found jobs, indicating the U.S. labor market is settling into a pace that will support the economy.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves