Today second flash reading of U.S. second-quarter GDP will be released at 12:30 GMT.

As the UK economy weathered the referendum storm much better than expected and the market has remained overall calm, the focus has once again shifted to rate hikes from the U.S. Federal Reserve. For that to happen, the U.S. economy needs to keep on showing the resilience. The GDP data if turns out to be much better than expected is likely to boost the mood of the U.S. dollar bulls ahead of the speech by Fed Chair Janet Yellen in Jackson Hole.

Past trends –

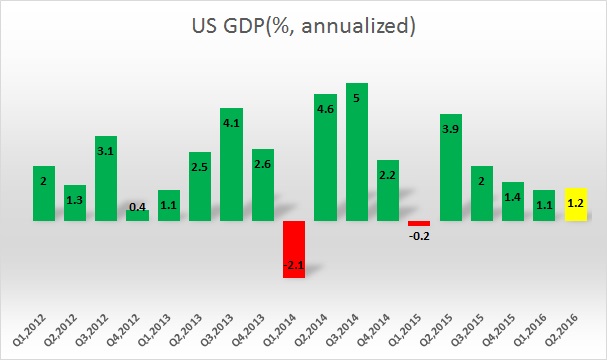

- U.S. GDP picked up pace since 2013 and increased pace in 2014. However, after rising 5 percentage and 2.2 percentage in previous two-quarters. U.S. GDP shrank by -0.1 percentage in the first quarter of 2015. Historically speaking U.S. economy, usually, falters in the first quarter.

- The second quarter was relatively better, with GDP growing at 2.1 percentage in the second quarter from the first.

- Growth has slowed further in third quarter, with GDP growing about 1.3 percentage.

- Final quarter GDP was much better than expected at 1.4 percentage, still meager compared to 2014.

- GDP grew by 1.1 percent in the first quarter of 2016 and the first flash reading of the second quarter GDP showed 1.2 percent growth.

Expectation today –

- It is expected to come in line with the flash estimate at 1.2 percent.

Market impact –

A positive number above 1 percent unlikely to make much of a difference but a number below 0.7 percent is likely to raise concerns and the dollar would decline. A negative reading could lead to an extremely volatile market.

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings

U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings