Today, U.S. Labor Department will release much anticipated non-farm payroll report. On Wednesday, ADP employment report was released and it was a blockbuster report. The report indicated that the Trump effect is quite prevalent in the Labour market. One of the biggest promises of Donald Trump was to create jobs, especially for Middle America, which used to rely heavily on manufacturing and mining jobs but since 2001, and especially after the 2008/09 Great Recession jobs in the manufacturing sector in the United States the sector has shed more jobs than it created. Trump has promised to reverse the course by bringing back manufacturing back to the United States.

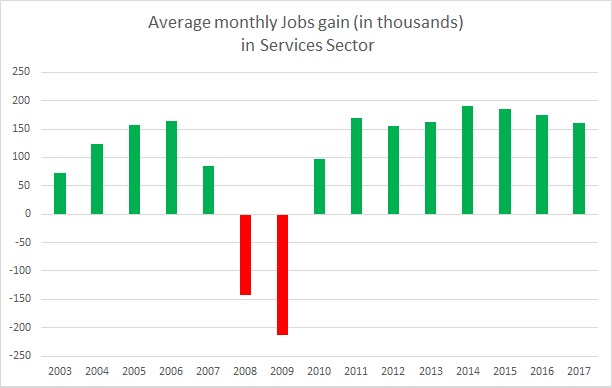

These above charts show based on ADP employment data, how the Labour market is performing this year compared to history,

- The first chart shows average monthly job creation in the services sector and one can see that job creation is on a downward path for last few years. So far this year, Services sector created 161,000 jobs every month on an average, which is the weakest figure since 2011.

- However, the second chart shows that the economy created 212,000 jobs on an average every month this year, which is the highest since 2014.

- And the credit goes to the Goods-producing sector (Chart 3), which created 51,000 jobs on an average per month, which is the highest since at least 2003.

- Manufacturing sector created 17,000 jobs on an average per month, which is the highest since 2014.

- Construction sector created 30,000 jobs on an average per month, which is the highest since 2005.

If President Trump is able to follow through his promise and create blue collar jobs, his reelection for a second term is only a matter of time.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election