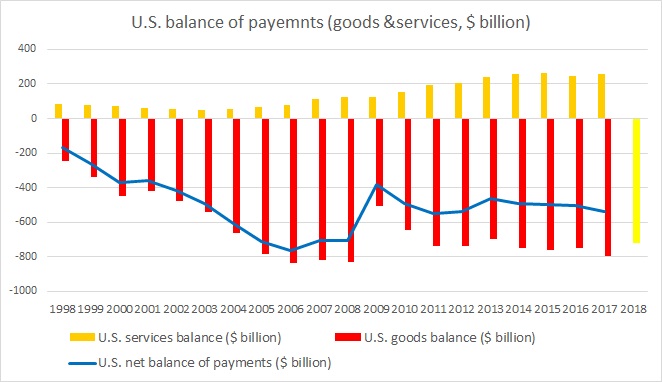

Despite all his harshest of rhetoric and actions towards ballooning U.S. trade deficit, President Trump seems to have failed to reign on it. Since his inauguration, President Trump and his team have taken actions to reign over the tariffs; imposing tariffs on steel and aluminum, taking harsher steps in terms of anti-dumping and countervailing duties, and imposing tariffs on goods from China but so far the impact isn’t getting reflected in actual data.

According to data from U.S. census bureau, the U.S. goods trade deficit with the rest of the world reached a new record high of $76.98 billion in October. At this rate, the U.S. trade deficit is set to surpass last year’s $795.69 billion in 2018.

The increasing trade deficit with more focused from investors thanks to President’s Trump’s war to reign on it is likely to act as a negative factor for the USD in the longer term.

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination