According to latest non-farm payroll report, US unemployment rate is at 4.9 percent as of July and is now being considered that the rate has reached long-term normal level. Technically speaking, yes, the rate has reached the long-term normal level then why people are cheering at Donald Trump’s (the republican presidential nominee) rally when he talks about bringing back jobs and bringing people back to the labor force? That is because this number is misleading.

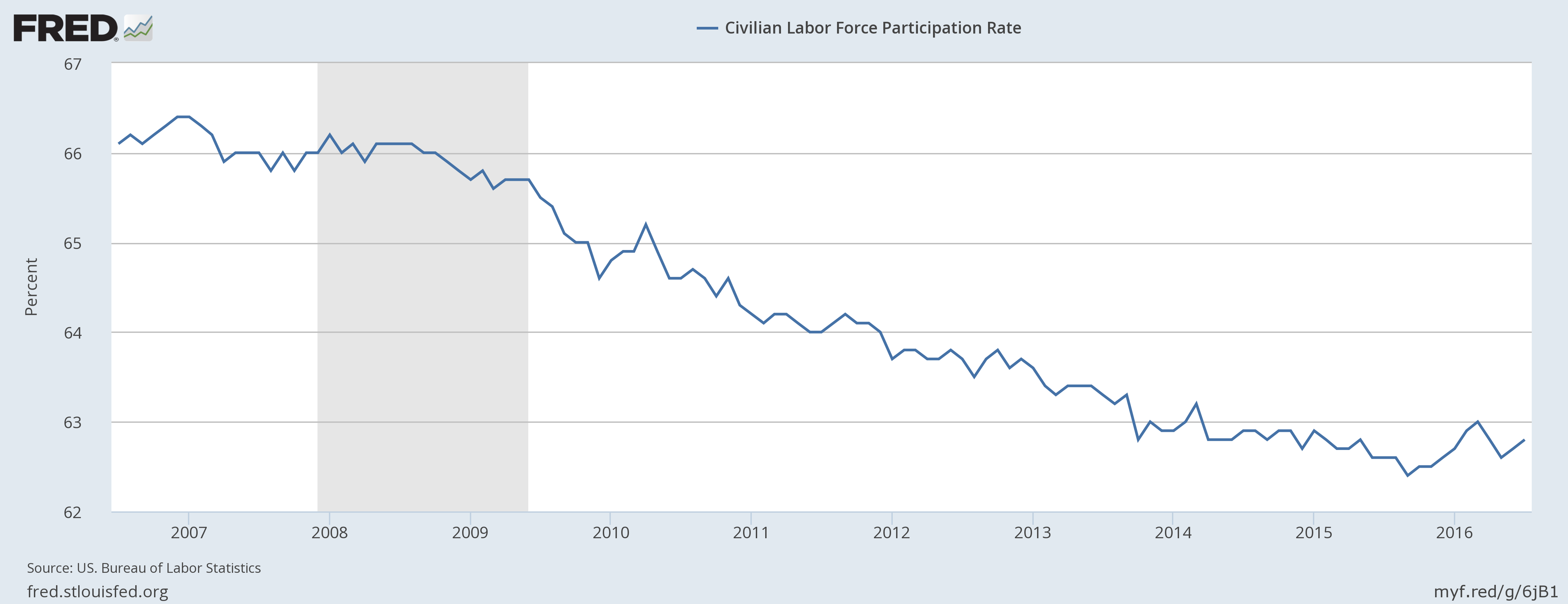

Actually, the way this rate is viewed is misleading. Unemployment rate drops not just because of increased employment, it drops when people leave the workforce, in other words when the participation rate drops. Since the 2008/09 crisis and from well before that, many people, as much 12.1 million has left the workforce due to frustrations, lack of skills, and technology takeover.

Let’s check the data-

Since 2000, when the participation rate peaked at 67.3 percent, 12.1 million people have left the workforce. If you calculate that number since the crisis of 2008/09 the figure is about 7 million. Now deducting the aged and those who has gone into higher studies, if you just simply add these people back to the workforce, the unemployment rate jumps up to 7.2 percent, which is quite ugly and poses doubts over the effectiveness of the monetary policy in reducing employment that has been credited with bringing back jobs. However, Federal Reserve policymakers do recognize this issue and recent days there have been lots of talks with regard to structural unemployment that could have been a factor behind lower wages and growth.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality