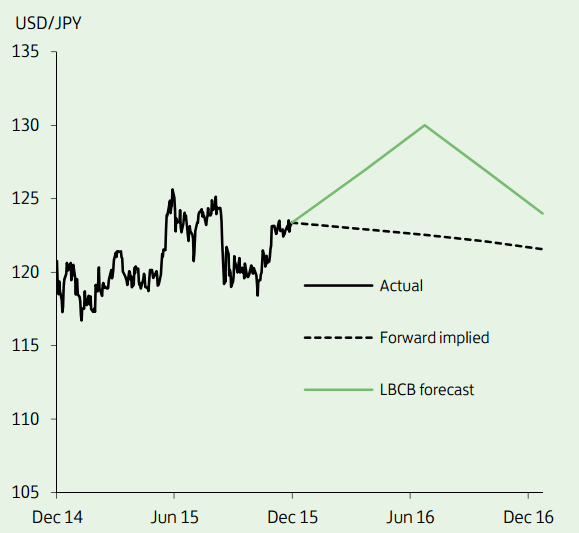

If the US Fed raises interest rates at its upcoming policy meeting, a generalised firming of the US dollar is likely to push USD/JPY higher over the coming months. The extent of any rise will partly depend on whether the BoJ follows the ECB's recent lead and cuts the deposit rate, currently 10bp, into negative territory and/or accelerates its QE programme. The possibility of further substantial policy stimulus could see USD/JPY break decisively above 130.

Recent comments, however, suggest that the BoJ is reluctant to ease policy further - partly on concerns that negative rates/more bond purchases could seriously impact market liquidity. The economic case for further stimulus has also weakened. Although 'core' inflation remains well below the BoJ's 2% target, base wages posted their eighth straight annual rise in October, while recent business surveys point to an improvement in Japan's growth next year.

"We expect USD/JPY to move up towards the 130 area, but expect the yen to find some support thereafter. We target 125 by end 2016 and 115 by end 2017", notes Lloyds Bank.

USD/JPY Outlook

Thursday, December 10, 2015 11:44 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022