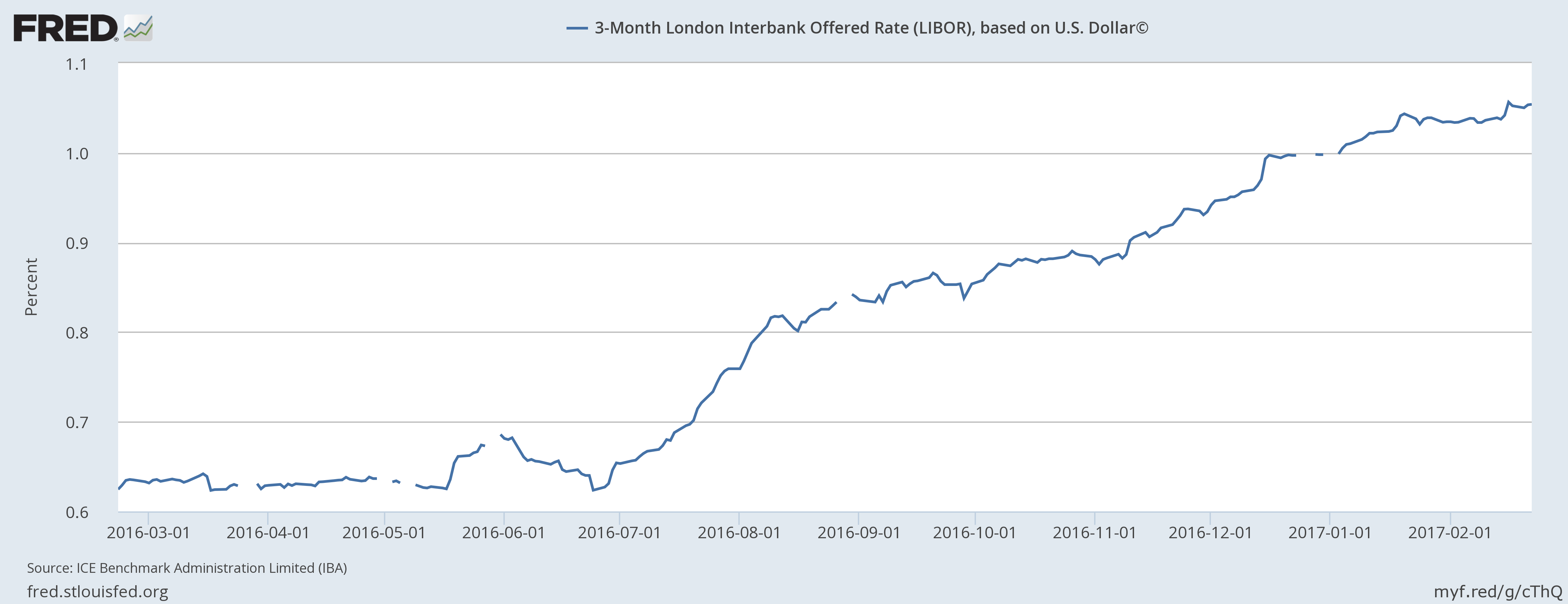

The cost of funding in US dollar reached the highest level since April 2009 as the interest rate reached just below 1.1 percent yesterday. The cost for banks to borrow in US dollar jumped by the most yesterday since December 2015, when the US Federal Reserve increased interest rates for the first time since the great recession of 2008/09. The USD Libor (London inter-bank offered rate) rose by 2.878 basis points to 1.09278 percent yesterday.

While an increase in the Libor pushes up other costs of funding, a rise not necessarily poses threats to the stock market. The majority of the rise is due to increases in the interest rate from Federal Reserve and the expectations that the rates would rise faster than expected.

Another key funding indicator, TED spread has eased from 67 basis points reached in last September but is still elevated at 54 basis points. TED spread is an important indicator as it measures investors’ and banks’ basis demands over the safe haven treasury.

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist