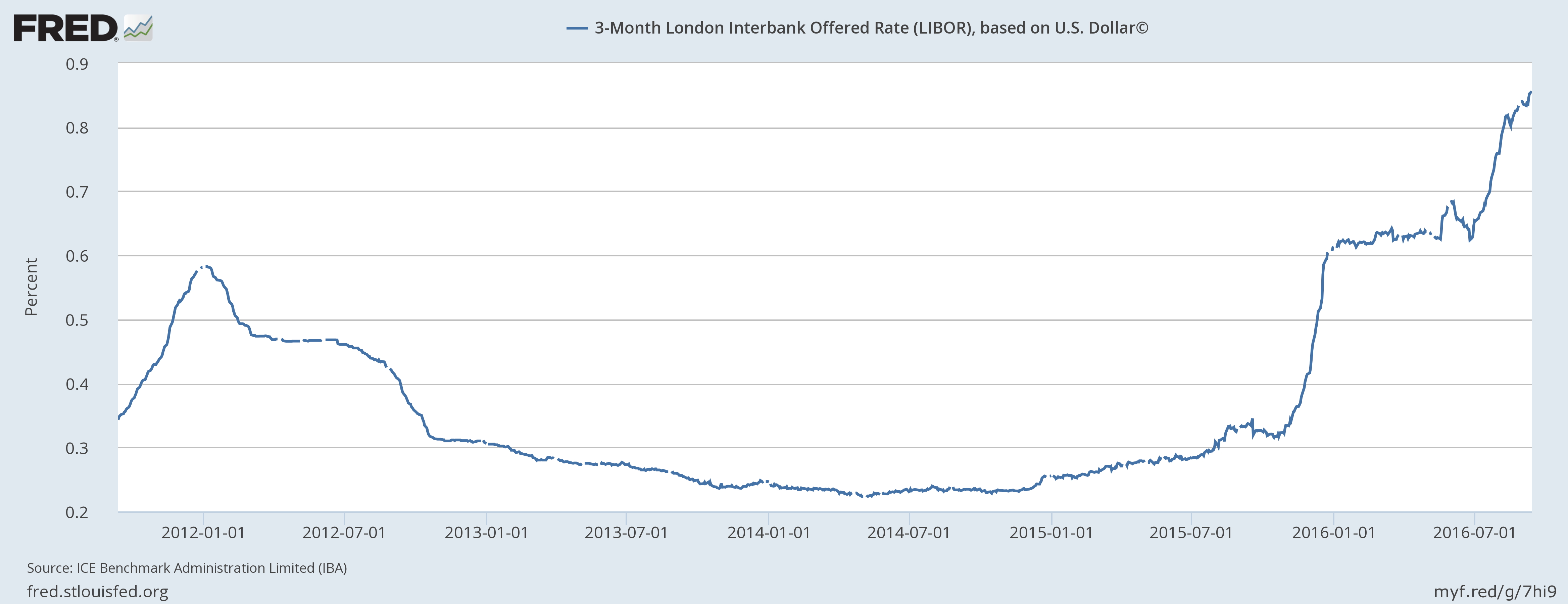

London Interbank Offered Rate (Libor) based on the U.S. dollar has already leaped to the highest level since the 2008/09 crisis and currently hovering around 0.86 percent (3-month). Compared to that, 3-month Libor based on the pound is hovering at 0.38 percent and for Euro, it is around negative 0.3 percent. So, it is clear that there are some shortages, with regard to the USD. We have listed below some of the factors that could be contributing to the rise,

- Rate hike anticipation from the U.S. Federal Reserve

- Increased risks in the financial systems that have been fuelling the demand for dollar-based funding

- The increasing number of corporate defaults, those are now much higher than 100 and at the highest since 2009.

- The major regulation changes would kick in from October on how money market funds operate and it would result in an increased cost of funding for the corporates.

Many market participants and analysts have been saying that the market is doing the tightening on behalf of the Fed, however, we feel that if the Federal Reserve increases interest rate in September (this Wednesday), even then the spread between the Libor and the U.S. treasury unlikely to shrink. We expect the Libor to move above 1 percent.

Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility