Euro zone unemployment rate dropped to 10.7% in October from 11% two month back. We at FxWirePro, have been arguing for further ECB action for quite some time, hints of which finally came at last meeting and action is expected this week. And key corner piece of our argument has been fragmentation in employment and overall high level of it.

Unlike FED, employment is not a mandate of European Central Bank (ECB) but any sustainable demand driven inflation is not possible to achieve when a large chunk of the workforce doesn't have jobs.

Latest report shows that asset purchase is working with unemployment dropping fast but still not fast enough given the size of the workforce which runs in several millions sitting outside for so long.

ECB sure has the ability to do more given relatively smaller balance sheet size (in value and both % GDP) and inflation relatively low.

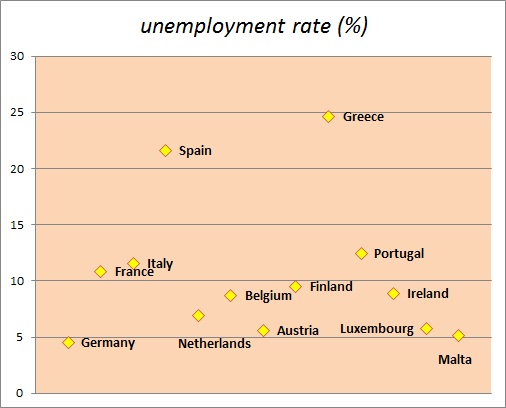

Regional employment growth review

- Fragmentation is diminishing but still at the higher end. While unemployment rate at very low in Germany (4.5%), Malta (5.1%), Austria (5.6%), countries like Greece (24.6%), Spain (21.6%), Cyprus (15.1%) suffering high level of unemployment.

- Moreover for most economies, level of unemployment is quite high - Portugal (12.4%), Italy (11.5%), France (10.8%).

Though Euro zone employment and growth, both headed in right direction, it remains too fragile to withstand headwinds from slowdown in China and debt crisis across emerging markets.

We strongly feel, European Central Bank has made the right choice, making it our favorite central bank and President Draghi an excellent orator.

Euro is trading at 1.06 against Dollar, awaiting the bazooka from ECB.

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed