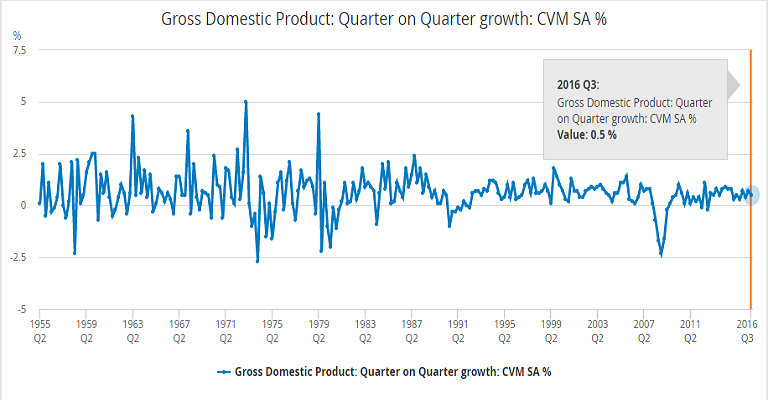

Data released by the Office for National Statistics on Thursday showed that UK Q3 GDP grew by 0.5 percent, beating forecasts for 0.3 percent growth. Growth was, however, slower than the 0.7 percent recorded in the second quarter.

Details of the report showed that the third-quarter figure was driven by a strong performance in the dominant services sector, which expanded by 0.8 percent. However, the other four sectors — industrial production, construction and agriculture — all contracted. Agriculture, forestry & fishing contracted 0.7 percent while manufacturing dropped 1 percent (after a 1.6 percent rise in 2Q16) and construction fell 1.4 percent.

"The first estimate of GDP growth in the third quarter was “a million miles from the zero or negative readings that we feared when survey indicators fell off a cliff after the Brexit vote,” said Alan Clarke of Scotiabank.

At their last two meetings, the Bank of England (BoE) Monetary Policy Committee (MPC) has said a majority of members expected to vote for a further rate cut if growth turned out in line with their August forecast of 0.1 percent. BoE last month raised its growth expectations for Q3 to 0.3 percent from 0.1 percent citing stronger-than-expected near-term economic activity.

Today’s data is significantly better than this and hence reduces the chances of further easing at BoE's meeting next week. That said, Brexit is mainly a risk to long-term growth and the medium- and long-term outlook for the U.K.'s gross domestic product remains fragile.

It is early to draw conclusions. Though today's data suggests immediate panic following the Brexit vote has dissipated, analysts will be looking for signs of possible reductions in the employment rate, investment spending and consumer behavior. Focus shall be on second estimate on GDP in a couple of weeks.

GBP/USD spiked from 1.2210 after the data, but UK GDP-led upward spike was quickly faded and the pair slipped to 1.2210 region. The pair was trading 0.17 percent higher on the day at 1.2264 at around 11:15 GMT. 20-day moving average at 1.2380 is major resistance on the upside. Technical indicators are with a neutral bias and only a break above 1.2380 could see further upside.

Trump Administration Sued Over Suspension of Critical Hudson River Tunnel Funding

Trump Administration Sued Over Suspension of Critical Hudson River Tunnel Funding  U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings

U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings  Australia’s December Trade Surplus Expands but Falls Short of Expectations

Australia’s December Trade Surplus Expands but Falls Short of Expectations  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  China and Uruguay Strengthen Strategic Partnership Amid Shifting Global Order

China and Uruguay Strengthen Strategic Partnership Amid Shifting Global Order  New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026

New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026  Oil Prices Climb as Middle East Tensions and U.S. Inventory Data Boost Market Sentiment

Oil Prices Climb as Middle East Tensions and U.S. Inventory Data Boost Market Sentiment  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Asian Markets Wobble as AI Fears Rattle Stocks, Oil and Gold Rebound

Asian Markets Wobble as AI Fears Rattle Stocks, Oil and Gold Rebound