Last week, European Central Bank (ECB) president Mario Draghi delivered a comprehensive easing package, which includes buying of corporate bonds.

Our analysis of the eligible QE universe showed, while it would be difficult for ECB to pursue the program without disturbing liquidity, it also shows Utilities to gain biggest from the purchases. After all the required reduction, it is evident that European investment grade bond universe is relatively small, just about €552 billion. Companies from France and Germany comprises of almost 50% of that universe. So it is possible in some countries ECB may face liquidity issues to start with.

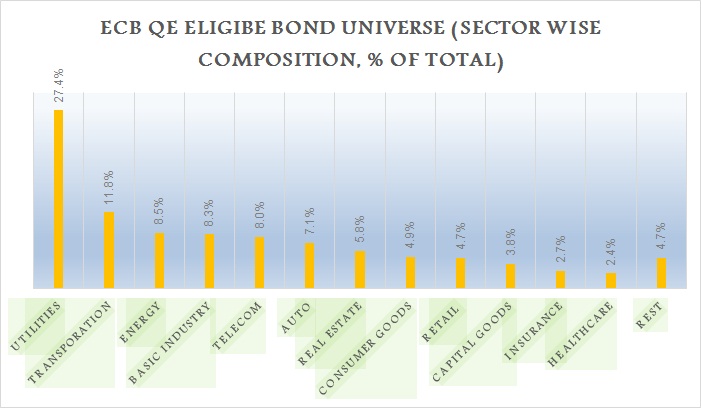

However Utilities remain a shining star despite the difficulties. More than 27% of the eligible bonds, as shown in the graph are from utilities sector, which comprises of €151 billion. Next two biggest are Transportation and Energy, with 11.8% and 8.5% share.

Trade idea –

- We expect EB purchase to sharply reduce the borrowing cost of corporates in these top three sector, so buying up bonds and shares are highly recommended over a period of one year. However, it is best to remain cautious over energy sector due to lower oil and gas price. That sector can be replaced with Basic materials, which stands next with 8.3% share of total universe, with €46 billion bonds eligible for buying.

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed