Consumer prices in Vietnam surged during the month of October, owing to a dry state of the economy, due to the massive droughts that occurred early this year, damaging crops and hence, leading to a scarcity in the supply of food products. Also, a continuously rising trend of inflation has raised hopes of a stable monetary policy by the central bank.

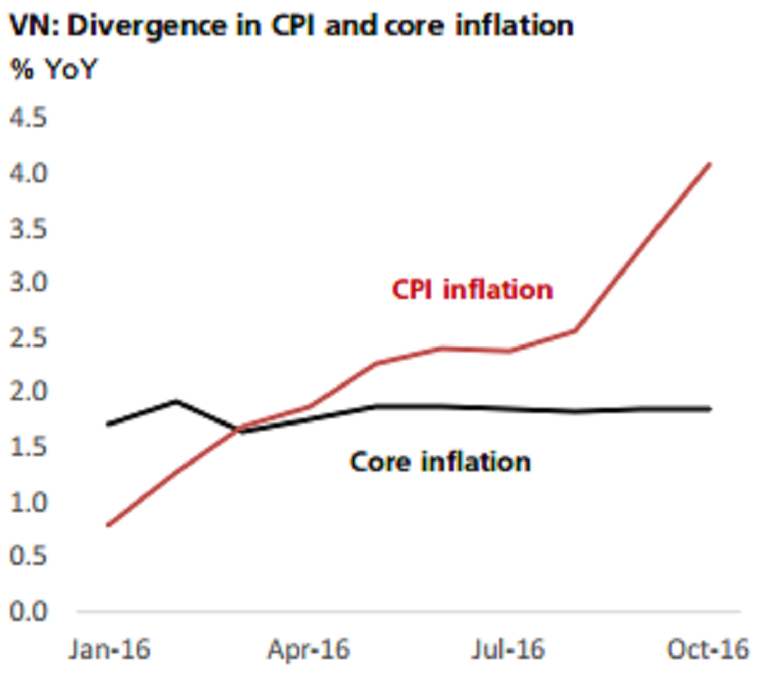

The headline all-items CPI inflation is certainly rising fast. It has risen to 4.1 percent y/y in October, up sharply from 0.8 percent in January. While the base effect is part of the reason, some one-off factors are the main drivers behind the rapid ascent. Price indexes for healthcare and education services have risen by a staggering 47 percent y/y and 11 percent y/y respectively in October.

Furthermore, core inflation has remained fairly stable at about 1.9 percent in October and headline inflation has averaged 2.3 percent year-to-date. With core inflation and average CPI well below 3 percent. The divergence between PCI inflation and core inflation has been widening post the natural hazard that struck Vietnamese farmers early in January this year.

Moreover, growth is slowing. Though part of the slowdown is weather related and the effect is expected to be transient, external economic conditions remain challenging, which could impact growth outlook in the medium term.

"Considering downside risk to growth associated with the uncertainties in the global economy and the transient nature of the inflationary pressure, we believe the central bank will focus on macroeconomic stability by maintaining the refinance rate at 6.50 percent in the coming quarters," DBS commented in its latest research report.

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment