Australian jobs increased by 42K in May which is a way beyond forecasts at 12.1K, compared to the previous 13.7K jobs.

The above healthy numbers led unemployment rate to 6.0% which is well below forecasts were at 6.2%, the lowest in a year.

Earlier, the Melbourne Institute annual inflation expectations showed June at 3.0% compared to 3.6% in May.

As a result the Aussie dollar has been gaining smartly against major currency baskets after this surge in jobs added in the latest monthly report.

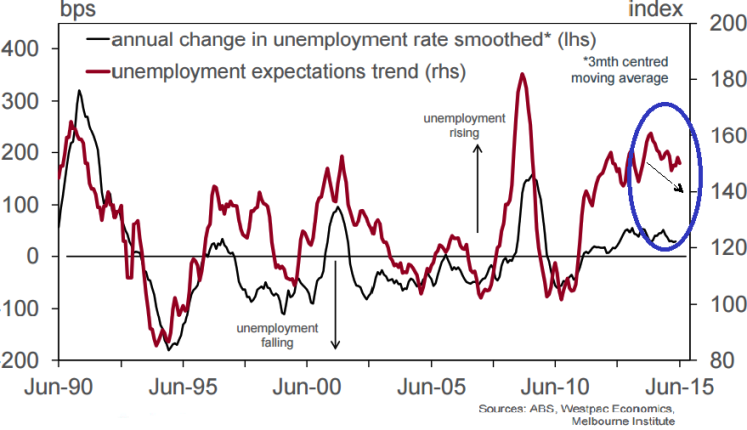

As shown in the above figures, we can figure out how moving average of the unemployment trend in Australia has been declining about 15 basis points with ease from Q1 of 2015.

FX options trade ideas: (AUD/NZD)

As a result of above news huge volatility in the FX market has been observed.

On an intraday perspective, every rise in price should be utilized for the best chance to short this pair for 1st target of 15 pips.

Aggressive speculators can audaciously eye upto 35 pips.

Use longs on digital slight Out-Of-The-Money put options of this pair at current levels to achieve above targets.

All shorts and digital options positions should be squared off EOD.

Vigorous AU unemployment data causes volatile FX markets

Thursday, June 11, 2015 7:40 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings