US benchmark West Texas Intermediate for July delivery advanced USD 1.29 to USD 61.43 a barrel on the New York Mercantile Exchange.

The US Department of Energy's inventory report for the week ending June 5 showed US crude stocks fell 6.8 million barrels and gasoline supplies dropped 2.9 million barrels.

European benchmark Brent oil for July delivery rose 82 cents to USD 65.70 a barrel in London.

Soon after US data showed decline in crude and gasoline inventories, crude oil prices rose massively for a second day in a row yesterday. We believe the really seems to continue today as well.

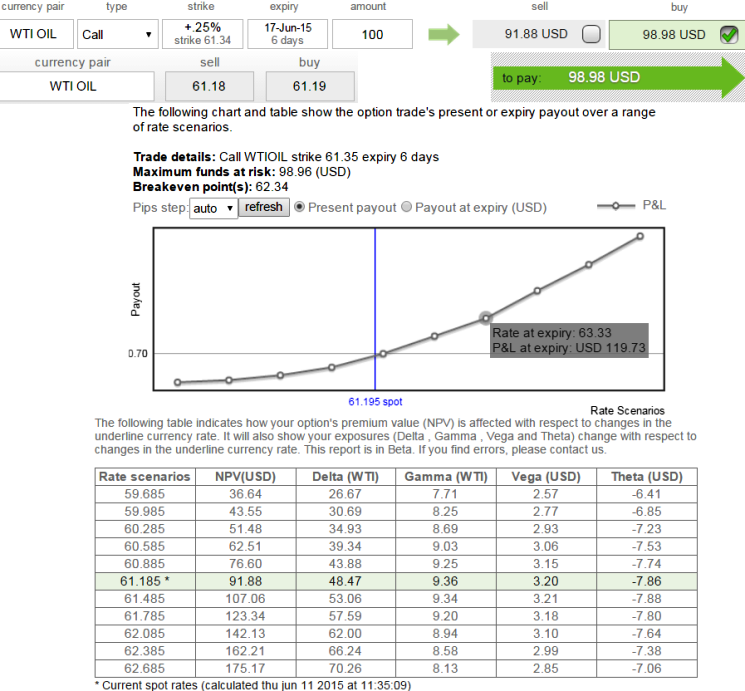

Options Trade Idea: (WTI Oil)

With a firm conviction that the above fundamental data is likely to prop up the crude prices as the demand supply equation signifies the superior price for the commodity.

For near term, -7.86 theta little above At-The-Money call options of WTI oil (strike +0.25% at 61.34) seem attractive for a target at 62.95 levels.

We think compared to buying the spot WTI outright; ATM WTI oil call option holder is able to gain leverage since the lower priced calls appreciate in value faster for every point rise in the price of the underlying commodity.

WTI Crude Inventory signifies Demand/Supply equation

Thursday, June 11, 2015 6:16 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand