North-American benchmark WTI is showing signs of extreme sentiment, which suggests that there might be reversal ahead.

Kindly note that extreme sentiment doesn't necessarily result in immediate reversal, as a matter of fact irrational exuberance (a term coined by Nobel Laureate Robert Schiller) can continue for greater extent. However, it surely indicates that it might be time to stay alert and cautious.

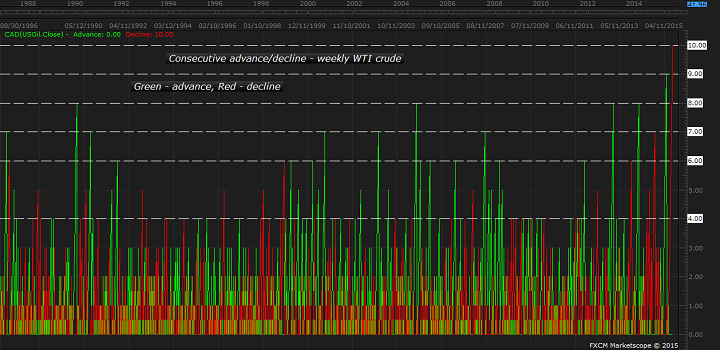

Last week, WTI not only reached lowest level since 2008/09 crisis when price traded as low as low as $36/barrel, it completed its longest weekly directional move in more than three decades at least.

WTI has declined for ninth straight week and on its way to mark 10 this week.

This extreme one sided move suggests that there might be reversal ahead. However since fundamental theme, which is supply glut, is in line with this move, sentiment extreme might continue further.

It is advised to stay cautious and look for early signs of reversal candles in both daily and weekly chart. Friday WTI almost formed but finally failed to build a very bullish hammer or Dragonfly Doji. Nevertheless, It has formed a medium bullish Doji with $39.5/barrel as leg low.

It is advised to stay cautious for further stronger signal.

WTI is currently trading at $42/barrel.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand