Wells Fargo has upgraded cybersecurity firm SentinelOne to Overweight, raising its price target by 53% to $29. The upgrade reflects growing market share gains from CrowdStrike, which has faced criticism following a significant outage last year. SentinelOne's AI-driven Singularity Platform is a key growth driver.

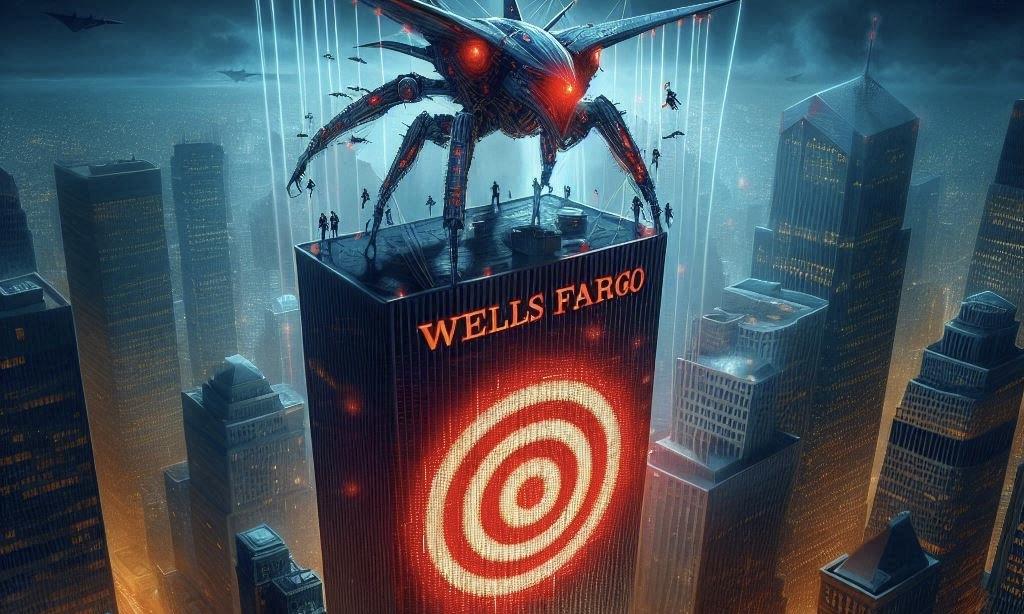

Wells Fargo Upgrades SentinelOne Amid Market Share Gains Over CrowdStrike Following Major Outage

According to Wells Fargo, Crowdstrike, the company responsible for the historic computer outage that affected 8.5 million computers and had global implications last year, is losing market share to its competitors. In an analyst note released on August 22, Wells Fargo upgraded cybersecurity firm SentinelOne to Overweight from Equal-weight and increased its share price target by 53% to $29 from $19.

The bank emphasized its conviction that SentinelOne is gaining market share over CrowdStrike, which has been severely criticized since the outage. Delta Airlines, for example, experienced extensive operational disruptions due to a faulty software update that impacted computers running Microsoft's Windows operating system.

Wells Fargo's SentinelOne enhancement results from an increased enterprise value to sales (EV/Sales) multiple. SentinelOne's new EV/Sales multiple is 8x, resulting in a share price target of $29. This upgrade is predicated on the company's capacity to secure market share from CrowdStrike following its July disruption. The bank believes that the market share gain is already underway.

SentinelOne is one of the cybersecurity firms that has capitalized on the increasing interest in artificial intelligence among cybersecurity customers. According to Wccftech, this resulted in the Singularity Platform being the focal point of the company's recent quarterly results, accounting for 40% of the total revenue, following a 100% annual growth rate.

The popularity of Singularity, which AI drives, has the potential to surpass SentinelOne's most significant business, its endpoint platform, shortly, similar to how AI semiconductor designer NVIDIA has transformed its data center business into its bread and butter.

Wells Fargo Cites Strong Survey Results as SentinelOne Surpasses CrowdStrike in Market Share Growth

Wells Fargo's upgrade is primarily motivated by its retailer survey, which, according to the bank, yielded results that were "only achieved once in the past three years, in 2Q22 (Jul)." SentinelOne achieved a 29% quarter-over-quarter increase, surpassing CrowdStrike, which experienced a negative 9% net.

Most importantly, 32% of the respondents reported that SentinelOne is gaining market share over CrowdStrike, while 52% are awaiting additional data. Nevertheless, Wells Fargo believes these consumers are "taking a rational approach" and could represent a further opportunity for SentinelOne.

SentinelOne's strategies are also responsible for the apparent market share growth rather than a pure play interest in its AI cybersecurity offerings. Analyst Nowinksi said it "began offering these discounts after the global outage."

Wells Fargo's upgrade is the most recent in a series of bullish statements from Wall Street regarding SentinelOne. Morgan Stanley's share price target was raised to $29 last week due to its enthusiasm for artificial intelligence.

Disaster or digital spectacle? The dangers of using floods to create social media content

Disaster or digital spectacle? The dangers of using floods to create social media content  Toyota Plans $19 Billion Share Sale in Major Corporate Governance Reform Move

Toyota Plans $19 Billion Share Sale in Major Corporate Governance Reform Move  Office design isn’t keeping up with post-COVID work styles - here’s what workers really want

Office design isn’t keeping up with post-COVID work styles - here’s what workers really want  Middle East Airspace Shutdown Disrupts Global Flights After U.S.-Israel Strikes on Iran

Middle East Airspace Shutdown Disrupts Global Flights After U.S.-Israel Strikes on Iran  The pandemic is still disrupting young people’s careers

The pandemic is still disrupting young people’s careers  Why have so few atrocities ever been recognised as genocide?

Why have so few atrocities ever been recognised as genocide?  Coupang Reports Q4 Loss After Data Breach, Revenue Misses Estimates

Coupang Reports Q4 Loss After Data Breach, Revenue Misses Estimates  Debate over H-1B visas shines spotlight on US tech worker shortages

Debate over H-1B visas shines spotlight on US tech worker shortages  Why a ‘rip-off’ degree might be worth the money after all – research study

Why a ‘rip-off’ degree might be worth the money after all – research study  Nintendo Share Sale: MUFG and Bank of Kyoto to Sell Stakes in Strategic Unwinding

Nintendo Share Sale: MUFG and Bank of Kyoto to Sell Stakes in Strategic Unwinding  FAA Plans Flight Reductions at Chicago O’Hare as Airlines Ramp Up Summer Schedules

FAA Plans Flight Reductions at Chicago O’Hare as Airlines Ramp Up Summer Schedules  Britain has almost 1 million young people not in work or education – here’s what evidence shows can change that

Britain has almost 1 million young people not in work or education – here’s what evidence shows can change that  Samsung Electronics Stock Poised for $1 Trillion Valuation Amid AI and Memory Boom

Samsung Electronics Stock Poised for $1 Trillion Valuation Amid AI and Memory Boom  Boeing Secures $166.8 Million U.S. Navy Contract for P-8A Engineering and Software Support

Boeing Secures $166.8 Million U.S. Navy Contract for P-8A Engineering and Software Support  Trump Media Weighs Truth Social Spin-Off Amid $6B Fusion Energy Pivot

Trump Media Weighs Truth Social Spin-Off Amid $6B Fusion Energy Pivot  Panama Investigates CK Hutchison’s Port Unit After Court Voids Canal Contracts

Panama Investigates CK Hutchison’s Port Unit After Court Voids Canal Contracts