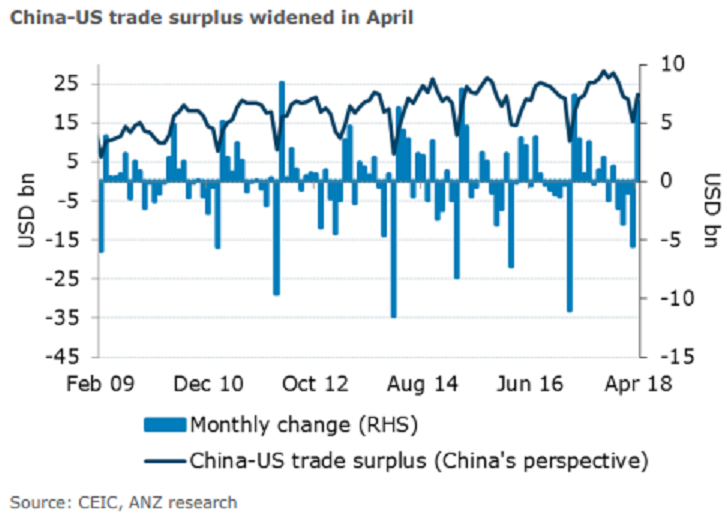

The widening China-US trade surplus reflects the difficulty of significantly closing the trade gap between the two countries in the near term, but it is unlikely to obstruct the constructive progress made recently, according to the latest report from ANZ Research.

The trade surplus between China and the US widened by USD6.8bn from March to USD22.2 billion in April, after having declined for four consecutive months. Despite some seasonality in the data, it also reflects the difficulty of achieving a compromise between the two countries (for example the US requests a narrowing of the bilateral trade balance by USD200 billion by 2020).

The exports of electronics were steady in April, likely due to some frontloading of shipments amid China-US trade tensions. Contrary to expectations, the exports of electrical products and automatic data processing increased 15.0 percent y/y and 22.4 percent y/y in April respectively, up from 2.4 percent and 15.2 percent in March.

Import growth extended its strong momentum, supported by major commodities and high-tech products imports. As was expected, the imports of major commodities, including iron ore and crude oil, have started to rebound in April (import volumes up 0.8 percent y/y and 14.7 percent y/y, respectively) as domestic business activities gradually resumed after the Lunar New Year holidays.

Natural gas imports also surged 214 percent y/y (in terms of volume) in April, more than triple the pace in Q1. High-tech products imports reported another double-digit growth, rising 27.5 percent y/y in April, exemplifying China’s economic transition from the low-end to high-end value chain.

"Nonetheless, we believe the high-level visits between the two (including Chinese Vice Premier Liu He’s upcoming visit to the US next week) are constructive moves in the right direction to resolving the trade tensions," the report added.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination