Preliminary reading on inflation is likely to stir heavy debate among policymakers within and out of European Central Bank (ECB), whether to act on headline or pause calling it an effect of lower energy prices.

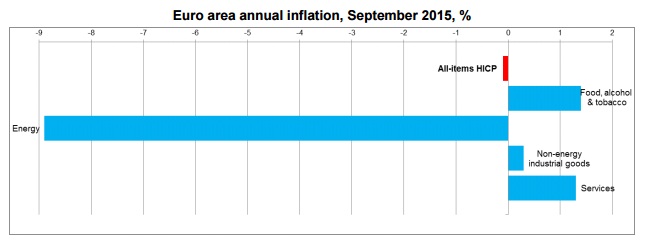

- Preliminary reading showed, European Monetary Union (EMU) is all set to decline into deflationary territory as reading showed -0.1% compared to 0.1% in August and 0.3% in May.

- Detailed reading shows, food, alcohol and tobacco will be contributing highest to Euro area inflation at 1.4% in September compared to 1.3% in August, followed by services (+1.3% compared to +1.2% in August) and non-energy goods (+0.3% compared to +0.4% in August).

- Energy remains a big drag in inflation contributing -8.9% compared to -7.2% in August.

Some of the hawkish members such as Bundesbank Chief Jens Weidmann might argue against further action from ECB to loose policy and not to chase energy prices.

However, if ECB is serious about inflation more dovish members would like to point out that,

- ECB targets headline inflation not a core measure which excludes energy prices.

- Consumer price index was down from 3% in 2011 to 0.5% by summer of 2014, well before energy market rout started.

ECB is very much likely to take further action to ease policy in a bid to push inflation higher.

Euro is currently trading at 1.12 against dollar.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand