Yes you are reading it right.

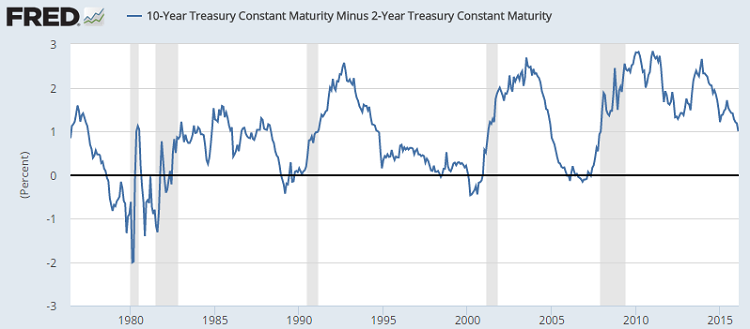

US treasury market, which has been a successful predictor of US recession in the past is just shy of 100 basis points from indicating a recession.

Since 2014, due to lower oil price and fading expectations over rate hike from US Federal reserve, as well as a drop in inflation reading has led to flattening of the yield curve. Moreover, since June, 2015 Yield curve flattening has fastened, more so this year as global equities have tumbled.

Now US yield curve is closer to jump from flat to getting inverted, which is yield is higher in the short dated treasuries than longer dated ones. Spread between 2 year treasury and 10 year treasury is at 1%.

Last time this has occurred was back in 2006, before 2008 recession and before that back in 2000, before 2001 recession that followed dot com bubble burst.

We have also discussed several other indicators such as Total business sales, industrial production, record mergers and acquisitions, all pointing to possibility of impending recession.

So this narrowing is making us more worried.

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings

U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings  Australia’s December Trade Surplus Expands but Falls Short of Expectations

Australia’s December Trade Surplus Expands but Falls Short of Expectations  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?