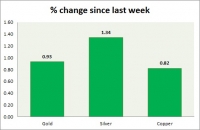

Commodities snapshot (precious & industrial)

May 25, 2018 13:39 pm UTC| Commentary

The metal pack is mixed today. The performance this week at a glance in chart table - Gold: Gold is getting some bids over risk aversion and as dollar weakens. Todays range $1308-1301 Gold is currently trading...

May 25, 2018 13:36 pm UTC| Commentary

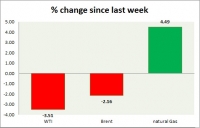

Energy pack is mixed in todays trading. Weekly performance at a glance in chart table, Oil (WTI) Oil price heading lower as Russia and Saudi Arabia considers cap easing to the tune of 1 million barrels per day....

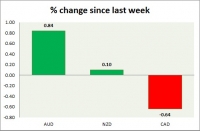

Currency snapshot (commodity pairs)

May 25, 2018 13:28 pm UTC| Commentary

Dollar index trading at 94.13 (+0.38%) Strength meter (today so far) Aussie -0.04%, Kiwi +0.18%, Loonie -0.59% Strength meter (since last week) Aussie +0.84%, Kiwi +0.10%, Loonie -0.64% AUD/USD Trading at...

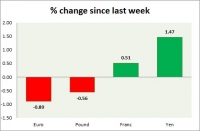

Currency snapshot (major pairs)

May 25, 2018 13:18 pm UTC| Commentary

Dollar index trading at 94.08 (+0.33%) Strength meter (today so far) Euro -0.48%, Franc -0.10%, Yen +0.15%, GBP -0.30% Strength meter (since last week) Euro -0.89%, Franc +0.51%, Yen +1.47%, GBP -0.56% EUR/USD...

May 25, 2018 13:16 pm UTC| Digital Currency Insights & Views Commentary

Tron, about $7.138 billion market capitalized cryptocurrency company has announced that its token migration from ERC20 TRX to Mainnet TRX would occur between June 21st June 25th (GMT+8). If your TRX is held on an...

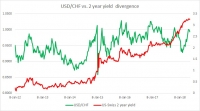

Fundamental Evaluation Series: USD/CHF vs. 2-year yield divergence

May 25, 2018 13:06 pm UTC| Commentary

During our evaluation period beginning 2012, the yield spread between the US 2-year bond and a Swiss equivalent has widened by almost 200 basis points but the exchange rate hasnt followed through as much as it should have...

Fundamental Evaluation Series: 2-year yield spread vs. GBP/USD

May 25, 2018 12:57 pm UTC| Commentary

The chart above shows, how the relationship between GBP/USD and 2-year yield divergence has unfolded since 2012. The cozy relationship between the yield spread and the exchange rate, in this case, is quite visible. Back...

- Market Data