Euro-area consumer confidence to improve

Nov 17, 2015 00:15 am UTC| Commentary

The consumer confidence indicator, published by the European Commission, is based on questions concerning the general economic situation, expectations of unemployment, savings and households financial situation over the...

Fed rate hike in December could force BI to remain on hold

Nov 16, 2015 23:34 pm UTC| Commentary Central Banks

The Bank of Indonesia (BI) is expected to remain on hold at its monetary policy meeting in November. Indonesias October CPI printed at 6.25% yoy, marking the second consecutive month of sub-seven percent inflation, and is...

BoJ softens calendar-based commitment to inflation

Nov 16, 2015 23:26 pm UTC| Commentary Central Banks

BoJ extended the timeframe for achieving 2% inflation by another six months to around H2 FY16 and cut its core CPI forecast while keeping its monetary policy unchanged. Governor Kuroda emphasized that an upward momentum of...

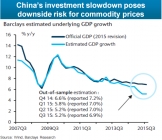

China’s growth not as robust as official data suggest

Nov 16, 2015 23:16 pm UTC| Commentary

Although Chinas Q3 real GDP growth was reported at 6.9% y/y, it was likely weaker. Analysis suggests that economic activity started to deviate from official headline GDP numbers in early 2014, with the gap ranging from...

UK inflation to rise to precisely zero

Nov 16, 2015 22:58 pm UTC| Commentary

There were only minor changes in the underlying forces driving CPI inflation in October. Food inflation looked pretty stable, as evinced by the BRC shop price data, and auto fuel prices have fallen by less than last month...

Some dovish signals from the BOE

Nov 16, 2015 22:45 pm UTC| Commentary Central Banks

While Fischer was candid in his explanations about the transmission of the exchange rate on US output and inflation, it can be assumed that all other central banks will be doing similar analysis. In fact, since the US...

Currency strength could rein in the Fed hawks

Nov 16, 2015 22:30 pm UTC| Commentary Central Banks

The US has seen a substantial impact from USD strength in recent years. Despite being less open than other developed economies, US GDP growth has been impacted by lower net exports while inflation pressures have been...

- Market Data