FxWirePro: The Day Ahead- 11th December 2018

Dec 11, 2018 04:50 am UTC| Commentary

Lots of economic data and events scheduled for today, and some with high volatility risks associated. Data released so far: Australia: National Australia Banks business condition index declines to 11 in November...

FxWirePro: Asian markets mixed, gold stabilizes above $1,240 mark

Dec 11, 2018 04:20 am UTC| Commentary

All the major Asian indices were trading on a mixed note on Tuesday. Gold was trading round $1,245 mark while silver was trading around $14.54 mark. Japans Nikkei was trading 0.30 pct lower at 21,156.50...

Australian bond yields recover from previous lows following short-selling

Dec 11, 2018 04:16 am UTC| Commentary Economy

Australian bond yields recovered from previous lows during Asian session Tuesday as investors engaged in short-selling amid a muted trading session that witnessed data of little economic significance. The yield on...

Dec 10, 2018 19:18 pm UTC| Commentary

Polish final headline inflation data for the month of November is set to be released this week. According to an Erste Group Research report, inflation rate is likely to have been confirmed at 1.2 percent on a year-on-year...

U.K. economic growth decelerates in October, economy likely to stall unless demand recovers

Dec 10, 2018 17:59 pm UTC| Commentary

The U.K. economic growth decelerated at the beginning of the fourth quarter, showed the ONS data. The figures come on the heels of more up-to-date survey evidence which implies the economy is approaching stall speed and...

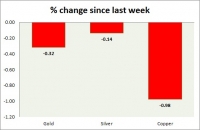

Commodities snapshot (precious & industrial)

Dec 10, 2018 17:46 pm UTC| Commentary

The metal pack is down today. The performance this week at a glance in the chart table - Gold: Gold is down today over strong USD. Remains upbeat on risk aversion. Todays range $1243-1251 Gold is currently...

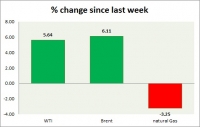

Dec 10, 2018 17:40 pm UTC| Commentary

Energy pack is mixed in todays trading. Weekly performance at a glance in chart table, Oil (WTI) Oil price is recovering as OPEC+ announced 1.2 million barrels of supply reduction. Down today on risk aversion...

- Market Data