Germany’s economic performance has been the driving force of the euro area’s recovery so far, and upbeat business confidence in October suggests that the German economy is on track for more robust growth. Brexit vote had temporarily unsettled companies in Germany, but recent data show signs of upward trend.

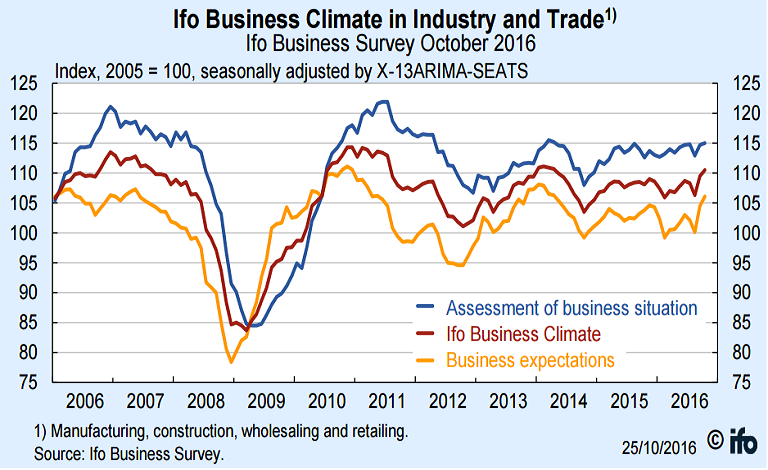

Data released on Tuesday by the Munich-based Ifo institute, showed that German business confidence in October improved to the highest level since April 2014, signalling uncertainty over Brexit continued to abate. German business climate index climbed to 110.5 from 109.5 in September, Business Expectations Index rose to 106.1 from 104.5 and Current Assessment Index increased to 115.0 from 114.7.

German GDP data is due on Nov. 15 and economists surveyed by Bloomberg expect Q3 GDP growth of 0.3 percent after 0.4 percent in the previous three months. However, the Bundesbank in its 'Monthly Report' released on Monday, has dismissed weaker growth in Q3 as temporary and said that underlying momentum remains strong. Export and business expectations in manufacturing suggest the situation could improve in the coming month, the central bank added.

Latest German data overall has also suggested a significant improvement at the start of the fourth quarter. The latest German PMI data, released on Monday, showed a strengthening in the manufacturing sector to a 33-month high and a notable recovery in the services sector. German out-performance would certainly complicate ECB policy making and Bundesbank opposition to an extension of bond purchases would tend to intensify.

While Germany’s economy may be headed for a pick-up, data suggest that the rest of Europe will continue expanding at a slower pace. Separate report released by official statistics office INSEE on Tuesday showed that France manufacturing confidence dropped slightly to 102 in October from 103.

"In Germany, growth may even have accelerated toward the end of the year. With other parts of the eurozone, particularly France and Italy, performing far worse than their larger neighbor, the ECB will remain under pressure to offer more policy support to achieve its region-wide inflation goal,” said Jennifer McKeown, chief European economist at Capital Economics.

EUR/USD largely muted on upbeat German Ifo data. The pair was 0.04 percent lower, trading at 1.0875 at around 12:00 GMT.

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound  U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings

U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings  India Services Sector Rebounds in January as New Business Gains Momentum: HSBC PMI Shows Growth

India Services Sector Rebounds in January as New Business Gains Momentum: HSBC PMI Shows Growth  U.S. Stock Futures Edge Lower as Tech and AI Stocks Drag Wall Street Ahead of Key Earnings

U.S. Stock Futures Edge Lower as Tech and AI Stocks Drag Wall Street Ahead of Key Earnings  Asian Currencies Trade Sideways as Dollar Stabilizes, Yen Weakens Ahead of Japan Election

Asian Currencies Trade Sideways as Dollar Stabilizes, Yen Weakens Ahead of Japan Election  Trump Extends AGOA Trade Program for Africa Through 2026, Supporting Jobs and U.S.-Africa Trade

Trump Extends AGOA Trade Program for Africa Through 2026, Supporting Jobs and U.S.-Africa Trade  Gold Prices Rebound Near Key Levels as U.S.-Iran Tensions Boost Safe-Haven Demand

Gold Prices Rebound Near Key Levels as U.S.-Iran Tensions Boost Safe-Haven Demand  New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026

New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026  China and Uruguay Strengthen Strategic Partnership Amid Shifting Global Order

China and Uruguay Strengthen Strategic Partnership Amid Shifting Global Order  Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile

Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile  Japan Declines Comment on BOJ’s Absence From Global Support Statement for Fed Chair Powell. Source: Asturio Cantabrio, CC BY-SA 4.0, via Wikimedia Commons

Japan Declines Comment on BOJ’s Absence From Global Support Statement for Fed Chair Powell. Source: Asturio Cantabrio, CC BY-SA 4.0, via Wikimedia Commons  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated