Guide to today’s important data and events

Oct 29, 2015 09:24 am UTC| Insights & Views

Lot of economic dockets scheduled for today, some with high risks associated. Focus on US GDP and German CPI. Data released so far Australia - Import price index rose by 1.4% in third quarter, while export price...

Oct 29, 2015 08:06 am UTC| Insights & Views

We kept reiterating this APAC pairs bearish trend often and often, now observe the daily price slumps on above charts. We spotted out a bearish spinning top at 1.0608 with days lows at 1.0523 thereby our earlier target...

Oct 29, 2015 07:20 am UTC| Insights & Views

Please observe how delta risk reversal numbers are getting higher negative values gradually in a long run (flashing at negative 1.65 for 1 year expiries). Volatility smiles most frequently show that traders are willing...

EUR, JPY and CNY to dig up more impetus from central banks’ easing season

Oct 29, 2015 07:10 am UTC| Insights & Views

On the verge of more easing likelihood from central banks like ECB and BoJ, this is revolving into realized vol generators and liquidity declines seasonally into year-end. As a result, you can observe the same into ATM...

Oct 29, 2015 06:24 am UTC| Insights & Views

We get more data from Asia (IP and GDP from Singapore, Korea and Taiwan; China PMIs at the end of the week), which could provide clarity on whether the IP cycle is indeed bottoming out.Despite these offsetting forces for...

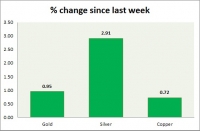

Commodities snapshot (precious & industrial)

Oct 28, 2015 17:47 pm UTC| Insights & Views

Metal pack is trading green in todays trading. Performance this week at a glance in chart table - Gold - Gold is sharply up heading into FOMC. Todays range - $1165-$1183. Gold might reach as high as $1225. However in...

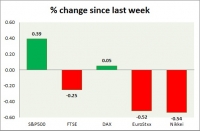

Oct 28, 2015 17:07 pm UTC| Insights & Views

Equities are all trading in green today. Kindly note all instruments mentioned here are CFDs, whose values might differ from cash or future traded. Performance this week at a glance in chart table - SP 500 - SP 500 is...

- Market Data