Guide to today’s important data and events

Jun 04, 2015 06:36 am UTC| Insights & Views

Not many economic dockets scheduled for today, risk associated is moderate. Focus in BOE rate decision. Data released so far - Australia - Retail sales disappointed in April with no growth. Trade balance deteriorated...

Why could SGD experience depreciation?

Jun 04, 2015 05:58 am UTC| Insights & Views

Singapores core inflation decreased from 1.0% to 0.4% YoY basis which is the lowest since 2010.Final revision of Q1 GDP stronger than projected at 2.6% versus consensus at 2.2% YoY basis.Industrial production growth has...

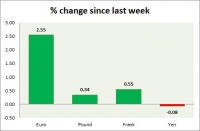

Currency snapshot (major pairs)

Jun 03, 2015 15:33 pm UTC| Insights & Views

Dollar index trading at 95.35 (-0.61%). Strength meter (today so far) - Euro +1.1%, Franc -0.17%, Yen -0.09%, GBP -0.03% Strength meter (since last week) - Euro +2.55%, Franc +0.55%, Yen -0.08%, GBP +0.34% EUR/USD...

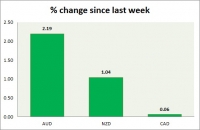

Currency snapshot (commodity pairs)

Jun 03, 2015 15:08 pm UTC| Insights & Views

Dollar index trading at 95.44 (-0.53%) Strength meter (today so far) - Aussie +0.57%, Kiwi +0.23%, Loonie -0.18%. Strength meter (since last week) - Aussie +2.19%, Kiwi +1.04%, Loonie +0.06%. AUD/USD - Trading at...

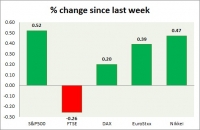

Jun 03, 2015 14:50 pm UTC| Insights & Views

Equities are trading in green today over Greek optimism. Performance this week at a glance in chart table - SP 500 - SP is up, as global sentiment recovered. Todays range 2121-2109. ADP employment showed job gains...

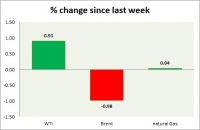

Jun 03, 2015 14:22 pm UTC| Insights & Views

Energy pack is trading in green today. Weekly performance at a glance in chart table. Oil (WTI) - WTI is facing tough resistance around $61 level. Todays range $61.1-59.6. WTI still remains vulnerable but might...

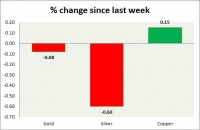

Commodities snapshot (precious & industrial)

Jun 03, 2015 14:06 pm UTC| Insights & Views

Metals are lagging despite drop in dollar. Performance this week at a glance in chart table - Gold - Gold is consolidating ahead of NFP, looking for further guidance. Weaker dollar failed to provide the necessary...

- Market Data