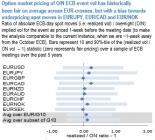

FxWirePro: Bearish EUR depends on tapering package, FVAs better choice over EUR/USD 1m ATM premiums

Oct 24, 2017 10:25 am UTC| Central Banks Research & Analysis Insights & Views

The ECBs zero interest rate policy makes the persistently high debt levels of consumers and businesses sustainable. This debt is, therefore, no obstacle to higher consumption and investment expenditures. On the other hand,...

Oct 24, 2017 09:00 am UTC| Central Banks Research & Analysis Insights & Views

The ECB to meet on this Thursday, the last but one meeting of 2017 is this week Thursday, 26 October. During the meeting in September, the president Draghi stated that the bulk of the decisions for recalibrating or...

Oct 24, 2017 06:17 am UTC| Digital Currency Research & Analysis Insights & Views

Reuters, the leading news network will soon have Hedge Projects BC30 (Buchman Crypto 30 Index) cryptocurrency indices listed alongside its mainstream counterparts like SP500 and others. With the inclusion of BC30 (Buchman...

Oct 23, 2017 13:06 pm UTC| Central Banks Research & Analysis Insights & Views

This week, weve got one of the most anticipated ECB policy meetings to look forward to. Given the weight of expectations, the risks are skewed against the euro this week. Mario Draghis task at the ECB meeting this week...

Oct 23, 2017 12:52 pm UTC| Research & Analysis Insights & Views

G3 currency pairs are locked into painfully tight ranges, with political developments in NAFTA, New Zealand, and Turkey behind the biggest FX moves. The broad dollar was swung around by a number of conflicting Fed...

FxWirePro: A glance through CAD and oil put options’ analysis

Oct 23, 2017 11:38 am UTC| Research & Analysis Insights & Views

We already stated in our recent write up that, USDCAD was trading higher and hits 6- week highs owing to the fragile Canadian economic data. The pair has broken-out the major resistance 1.2600 and heading for 1.2675 marks...

Oct 23, 2017 10:00 am UTC| Research & Analysis Insights & Views

After a several month long cycle of policy repricing that culminated in outlier back-to-back policy rate hikes in July and September, CAD has seen some understandable consolidation. The 4% USDCAD retracement since 8 Sept...

- Market Data