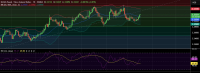

FxWirePro:USD/JPY neutral in the near-term, scope for downward resumption

Dec 17, 2025 04:07 am UTC| Technicals

USD/JPY ticked higher on Wednesday as investors were cautious ahead of the key BoJ meeting this week. The BOJ is likely to raise its short-term policy rate to 0.75% from 0.5% at its December 18-19 meeting on receding...

FxWirePro: GBP/NZD remains bullish as rally continues

Dec 16, 2025 22:34 pm UTC| Technicals

GBP/NZD firmed on Tuesday as UK PMI results exceeded expectations, strengthening the pound. The SP Global Purchasing Managers Index for December increased to 52.1 from 51.2 in November. The overall PMI and the...

FxWirePro: GBP/AUD maintains bullish bias with focus on 2.0300 level

Dec 16, 2025 22:25 pm UTC| Technicals

GBP/AUD rose on Tuesday as stronger-than-expected UK PMI data buoyed sterling across the board. The SP Global Purchasing Managers Index rose to 52.1 in its preliminary measure for December from 51.2 in November. ...

FxWirePro: EUR/NZD edges lower but bullish outlook persists

Dec 16, 2025 22:14 pm UTC| Technicals

EUR/NZD retreated on Tuesday as markets assessed euro zone Business activity data. Euro zone activity lost steam at the end of 2025 as manufacturing contraction deepened and services growth eased. The composite PMI...

FxWirePro: EUR/AUD uptrend loses steam, remains on bullish path

Dec 16, 2025 22:07 pm UTC| Technicals

EUR/AUD initially gained but gave up ground on Tuesday as investors digested Euro zone business activity data. Euro zone business activity growth slowed more than expected at the end of 2025, as a deeper manufacturing...

FxWirePro: USD/CAD slides as U.S. dollar weakens after jobs data

Dec 16, 2025 16:40 pm UTC| Technicals

USD/CAD extended weakness on Tuesday as greenback dollar dipped after U.S. jobs report that showed the unemployment rate rose last month from September. The U.S. economy added 64,000 jobs in November, exceeding...

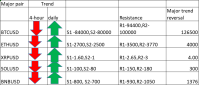

FxWirePro- Major Crypto levels and bias summary

Dec 16, 2025 16:31 pm UTC| Digital Currency Technicals

Major Crypto levels and bias...

- Market Data