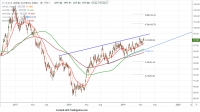

FxWirePro: USD/TWD rejects key resistance at 31.57 mark, short term trend reversal likely

May 24, 2019 05:11 am UTC| Technicals

USD/TWD is currently trading around 31.49 marks. It made intraday high at 31.56 and low at 31.47 marks. Intraday bias remains slightly bearish till the time pair holds key resistance at 31.57 marks. A daily...

FxWirePro: EUR/CHF pauses downside at 1.12 handle, bias bearish

May 24, 2019 04:30 am UTC| Technicals

EUR/CHF chart - Trading View EUR/CHF consolidates previous sessions losses, extends marginal gains in the Asian session. Price action has paused downside at 1.12 handle, bias remains bearish. Momentum studies are...

FxWirePro: USD/JPY rejected at cloud and 21-EMA, dip till 108.80 likely

May 24, 2019 04:00 am UTC| Technicals

USD/JPY chart - Trading View USD/JPY consolidates previous sessions losses, trades rangebound in the Asian session. Recovery in the pair was capped at 21-EMA and cloud resistance. Risk-off sends US yields lower...

May 24, 2019 04:00 am UTC| Technicals

Trend line resistance- 98.76 DXY has halted its 10- day on winning streak and shown a minor decline from high of 98.37. The index made a low of 97.03 on May 13th2019 and jumped more than 130 pips from that level. It...

FxWirePro: USD/THB remains volatile in early Asian hours, faces immediate resistance at 32.02 mark

May 24, 2019 03:49 am UTC| Technicals

USD/THB is currently trading around 31.92 marks. It made intraday high at 31.93 and low at 31.79 marks. Intraday bias remains bullish till the time pair holds key support at 31.70 marks. On the top side, key...

FxWirePro: Gold recovers on global stock market sell-off, good to buy on dips

May 24, 2019 03:20 am UTC| Technicals

US Dollar Index -Trend Negative.US Dolalr inde has once declined after showing a jump above 98.37 previous high was 98.32 made on Apr 25th2019.Any break below 97.68 confirms further weakness and a decline till...

FxWirePro: XAG/USD stabilizes above $14.50 mark, stay bullish

May 24, 2019 02:35 am UTC| Technicals

XAG/USD is currently trading around $14.54 marks. It made intraday high at $14.59 and low at $14.53 levels. Intraday bias remains bullish till the time pair holds key support at $14.40 mark. A daily close...

The “Takaichi Trade”: How Japan’s First Female PM Is Shaping the Yen

How the US–India tariff truce boosts major Indian industries, Surat to Pharma

- Market Data