Australia’s gross domestic product (GDP) for the first quarter of this year rose slightly above market expectations, with the strength concentrated in net exports and public spending, while growth in household consumption was softer after the strong gain in Q4. Measures of inflation continued to lift, although they remain low by historical standards.

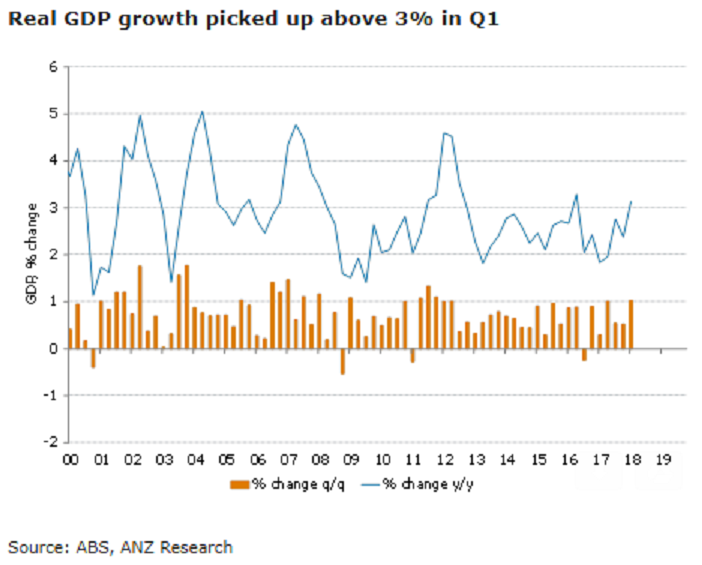

GDP was up a strong 1.0 percent q/q in Q1, which along with upward revisions to earlier data lifted annual growth 3.1 percent. This is the fastest growth since 2016, when growth briefly ticked above 3 percent and only the second time since 2012 that y/y growth has been above 3 percent. The result was a little stronger than our own forecasts and also above the RBA’s forecast published in the May Statement on Monetary Policy.

The rebound in growth was helped by a turnaround in net exports as well as strong public spending and a sharp rise in profits. On the expenditure side, net exports contributed 0.3ppt to the rise, while public sector demand contributed 0.4ppt. Household consumption grew a soft 0.3 percent, although this follows a 1 percent jump in Q4 and leaves annual growth at 2.9 percent.

"The RBA is likely to be relieved with the rebound in growth, but cognisant that the outlook is far from assured. While business conditions remain buoyant, the household sector remains under pressure from soft wage growth, a low saving rate and weakening house prices. The risks to the global economy have also increased. In this environment, and with inflationary pressures still modest, the RBA is clearly on hold for some time," ANZ Research commented in its latest report.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm