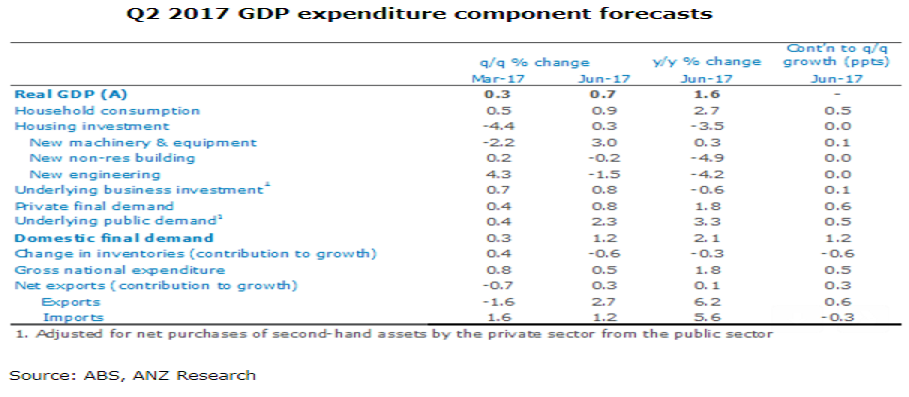

Australia’s gross domestic product (GDP) for the second quarter of this year is expected to have risen 0.7 percent q/q, following a modest rise of 0.3 percent q/q in the first quarter, thus likely to leave the annual growth at a tepid 1.6 percent. That said, there are a number of temporary factors that held down growth in the first half and surveyed business conditions suggest that the economy is actually in better shape than these numbers suggest, ANZ Research reported.

At 0.7 percent q/q, GDP growth looks likely to be a broadly in line with the RBA forecasts published in the quarterly Statement on Monetary Policy last month. Of importance in tomorrow’s release will be the household consumption and wages numbers. While retail sales volumes rose strongly in the quarter, it will be interesting to see whether this reflected overall strength in consumption or if it came at the expense of services spending.

On wages, yesterday’s Business Indicators release showed that the wages bill rose a solid 1.2 percent in Q2, but this largely reflects the strength in employment in the quarter. Of more interest will be the wage rate in tomorrow’s report, which is expected to show only modest growth.

"While the activity outlook remains positive, underpinned by solid business investment and public spending, we expect that the ongoing softness in various measures of wage and price inflation will keep the RBA on hold for some time yet, especially given the housing market looks to be cooling," the report commented.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal