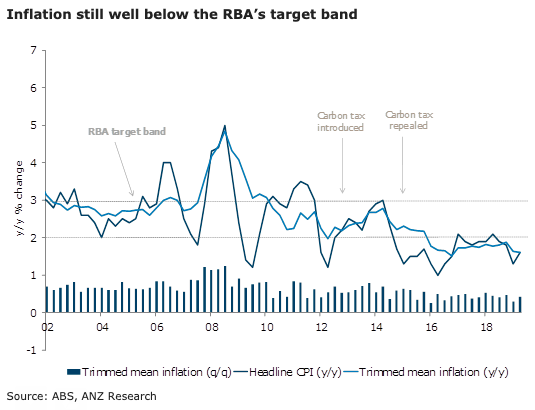

Australia’s headline inflation for the second quarter of this year rebounded after being flat in Q1. In annual terms, it increased to 1.6 percent (from 1.3 percent in Q1). The largest positive contributions for the quarter came from fuel prices rising 10.2 percent, international holiday travel and accommodation increasing by 2.7 percent and tobacco prices rising 2.4 percent.

Partly damping these increases were fruit and vegetables prices falling 2.8 percent and electricity prices coming off 1.7 percent.

Importantly, trimmed mean inflation, the measure of inflation most focused on by the RBA, increased 0.4 percent q/q. This saw the annual number unchanged at 1.6 percent. The RBA in its May SoMP forecast inflation to be 1.6 percent by June 2019.

So although 1.6 percent is below its inflation target, this print does not put pressure on the Bank to cut interest rates quickly again and allows it the room to see how future data play out.

Although trimmed mean inflation picked up this quarter, the ANZ Diffusion Index (which measures the proportion of the basket with annualised price rises of 2.5 percent or more) fell to 34 percent from 44 percent in Q1.

"The RBA’s forecasts to be published in the Statement on Monetary Policy next week will assume two further rate cuts (reflecting current market pricing). It is very difficult to see how the Bank will achieve its target of 4.5 percent unemployment in a timely manner without further easing. Consequently, we continue to expect another cut in the next few months, the exact timing of which we will firm up after next week’s RBA statement," ANZ Research commented in its latest report.

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal