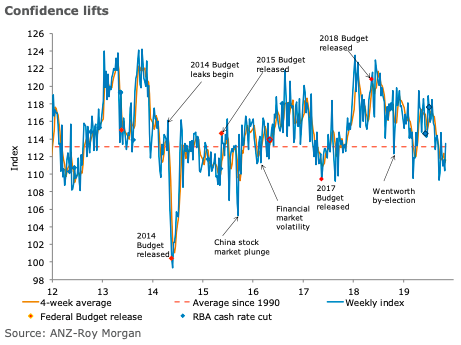

Australia’s ANZ-Roy Morgan index made a strong recovery last week, rising 2.8 percent after the prior week’s 1.1 percent drop. Financial conditions were positive, with current finances up 1.6 percent, while future finances rose for the fourth consecutive week in gaining 2.6 percent.

Economic conditions finally recovered with substantial gains compared to weak performance for the last few weeks. Current economic conditions gained 2.6 percent, while future finances were up significantly by 6.8 percent.

The rise in future economic conditions is pleasing, as this particular sub-index has been in a downtrend for the last four weeks.

The 'Time to buy a household item' also strengthened, increasing 1.3 percent. The four-week moving average of inflation expectations declined by 0.1ppt to 4.0 percent.

"Sentiment recovered last week, possibly in part on the back of the RBA Governor’s comments about a “gentle” upturn in the economy. Reasonable CPI data and the lift in building approvals may have also contributed to the lift in sentiment. The jump in future economic conditions was notable, as this index has been acting as a major drag for the whole index. Better global news, reflected in higher global share prices, likely also impacted. The weekly inflation expectations sub-index remained at its recent low and the RBA is likely to be pay some attention to that," said David Plank, ANZ’s Head of Australian Economics.

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals