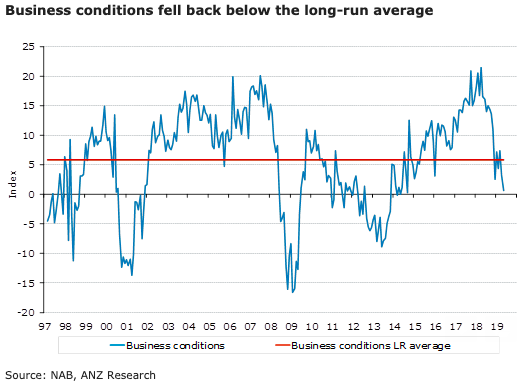

Australia’s business conditions for the month of May slumped to its weakest level since they briefly fell to almost zero in September 2014, although the confidence was up quite strongly during the period.

Business conditions fell to 0.6 in May. The sub-indices were mixed: profits, capacity use, and trading fell, while employment, exports, labour costs and purchases costs rose modestly. At 2, the employment index is consistent with modest jobs growth, while capacity use points to a sharply higher unemployment rate.

Conditions fell in New South Wales and Victoria to well below average levels, though the three-month moving averages are still around or close to average. Conditions also fell a touch in South Australia, though are still strong; and they remain above average in Tasmania – though well off recent highs. Conditions continued to deteriorate in Western Australia.

The change in conditions across industries was mixed. Mining fell, but remains elevated. Retail conditions deteriorated very sharply, to the weakest monthly level since March 2001. Transport was down by some margin, while the finance and recreational sectors fell a smaller amount. Manufacturing, construction and wholesale all rose somewhat.

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains