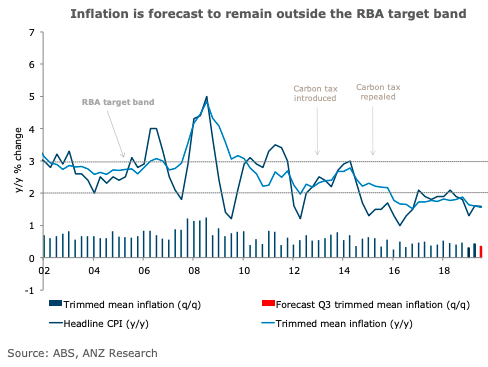

Australia’s headline inflation for the third quarter of this year is expected to come in at 0.5 percent q/q in, with the annual rate remaining at 1.6 percent, according to the latest report from ANZ research. The largest contributor to the headline figure was holiday travel and accommodation.

Petrol prices are expected to detract from inflation this quarter, after rising sharply in the previous quarter. Trimmed mean inflation, the underlying measure of inflation focused on by the RBA, is expected to come in at 0.4 percent q/q.

This would see the annual rate stay at 1.6 percent. The risks to trimmed mean inflation for the quarter are seen to be as skewed to the downside slightly; forecast for trimmed mean inflation is in line with what the Reserve Bank of Australia (RBA) published in its August Statement of Monetary Policy (SOMP), the report added.

A number in line with this won’t put any pressure on the RBA to act sooner than currently expected. At this point, trimmed mean inflation would need to considerably disappoint markets to think the RBA will cut again in 2019.

"If the RBA eases in November, it is likely to be the result of a combination of the Fed easing in October and another weak month of retail’s sales suggesting that the tax cuts are not being spent rather than soft inflation," ANZ Research further commented in the report.

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure