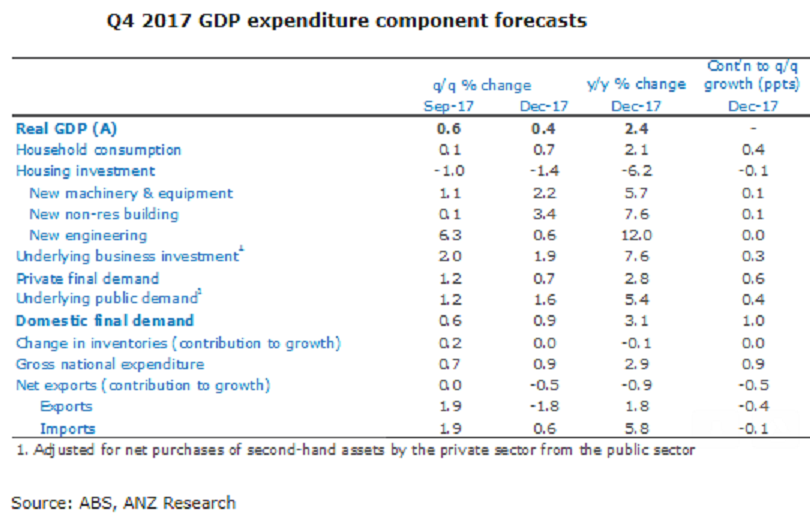

Australia’s fourth-quarter gross domestic product (GDP) is expected to have risen just 0.4 percent q/q. This follows a rise of 0.6 percent q/q in Q3 and would see annual growth drop down to 2.4 percent, according to a recent report from ANZ Research.

At 0.4 percent q/q and 2.4 percent y/y, GDP growth looks to be a little weaker than the RBA forecasts in the most recent Statement on Monetary Policy.

The main new pieces of information since ANZ’s preliminary forecast last week are significantly weaker profits, wages and inventories and slightly stronger government spending and net exports. The biggest miss for us was on the wages numbers: the wages data in the Business Indicators release on Monday and in Tuesday’s Government Finance data were all weaker than we had anticipated.

This suggests that the wage rate in Wednesday’s GDP report is likely to show only a very modest improvement in terms of quarterly growth. This, alongside the weakness in January retail sales, makes us a little more concerned about the outlook for household incomes and consumption.

"On that front, we see the household consumption and wages numbers in the GDP report as being of key importance. Retail sales volumes point to a sizeable bounce in consumption after the very weak 0.1 percent rise in Q3. On wages, we will be watching closely the GDP measure of average wages. Preliminary data suggest that this is likely to remain soft, although base effects suggest that the annual growth rate will tick up," the report added.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility