Australia’s housing finance for the month of September fell in line with expectations in September, with declines across all segments. The recent fall in owner-occupier finance suggests that weaker sentiment is now also having an impact on the broader market, according to the latest report from ANZ Research.

The value of housing finance commitments fell sharply again in September. Following some downward revisions to the August results, the value of finance has fallen 7.5 percent in the last two months, which is one of the weakest consecutive results on record.

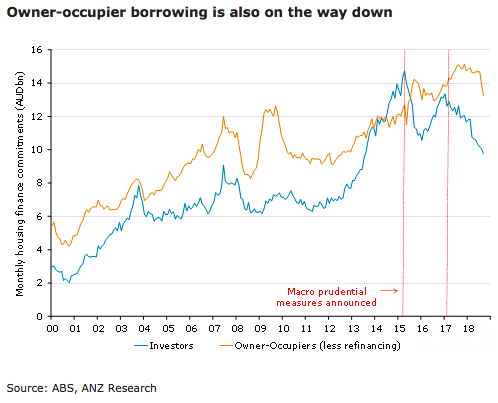

For the second month running, most of the monthly decline was in the owner-occupier segment. Owner-occupier approvals are now 11 percent lower than a year ago, which is the largest decline since 2010.

While most of the focus around credit tightening has been on investors, the accelerating decline in owner-occupier borrowing suggests that weaker sentiment in the housing market is having an impact on the demand for credit.

"Further weakness in house prices is likely, although smaller loans should be considered a positive development from a financial stability point of view," the report commented.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions