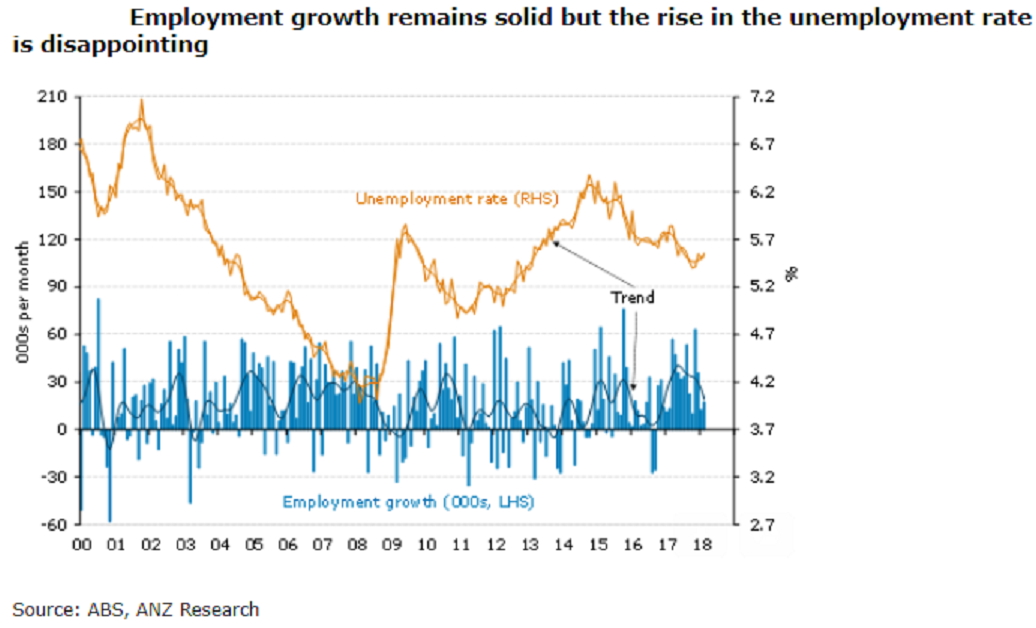

Australia’s Employment rose again in February, extending the record string of jobs gains. The rise in both the unemployment and underemployment rates was, however, quite disappointing. The strength in the jobs market is clearly drawing in more workers, but ongoing labor market spare capacity suggests wage pressures are likely to remain quite muted.

Employment rose for the seventeenth straight month, with a gain of 17.5k jobs in February, following a downwardly revised rise of 12.5k in January. While this is a fresh record string of gains, the rise in both unemployment and underemployment took the gloss off the report.

Full-time jobs rebounded a sharp 65k after the 53k drop in January. The numbers look to be capturing some residual seasonality, with full-time jobs falling in the past three Januarys. Taking the two months together, full-time jobs are up just 12k. Hours worked rose a strong 1.2 percent m/m, although over the past three months they are down 0.5 percent.

Somewhat surprisingly, the unemployment rate ticked back up to 5.6 percent, alongside a rise in the participation rate back up to 65.7 percent. The female participation rate edged back to its record high of 60.5 percent, while male participation remained unchanged at a still-high 70.9 percent.

"Leading indicators continue to suggest that the labour market will tighten further. Record high business conditions and ongoing growth in job ads suggest that solid jobs growth should continue and the unemployment rate should decline further in coming months," ANZ Research commented in its latest report.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022