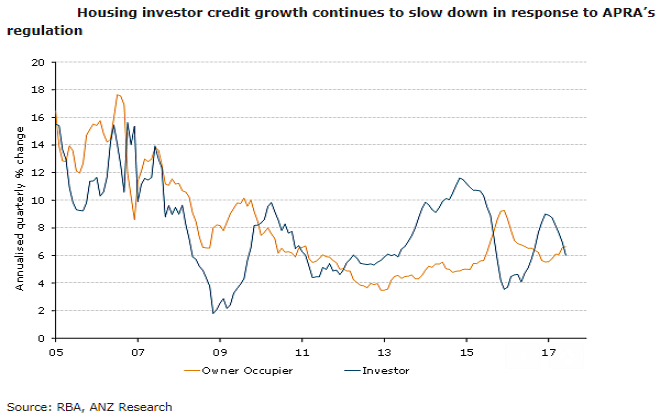

Australian private sector credit recorded a solid increase in June, led by a rebound in the business sector after several months of weakness. The divergence between the investors and owner-occupier housing credit continued, with the former still slowing in response to APRA’s macro-prudential regulation.

Housing credit posted another 0.5 percent m/m rise in June, although at the margin (2 decimal places) this was the slowest monthly increase in a year. The slowdown in investor borrowing continued, and quarterly annualized growth now sits at 6.0 percent.

On the other hand, credit to owner-occupiers again posted faster monthly growth than the investor segment. The divergence between the segments kept total annual housing credit growth at 6.6 percent y/y, reflecting a stabilization at a marginally higher rate than at the start of the year.

Business credit recorded the strongest monthly rise since December 2016, up 0.9 percent m/m. This is a welcome result after a period of weakness, but we do not expect it to be sustained indefinitely. Business finance approvals have remained weak in recent months, and suggest that growth in the stock of business credit is likely to ease from here, ANZ Research reported.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns