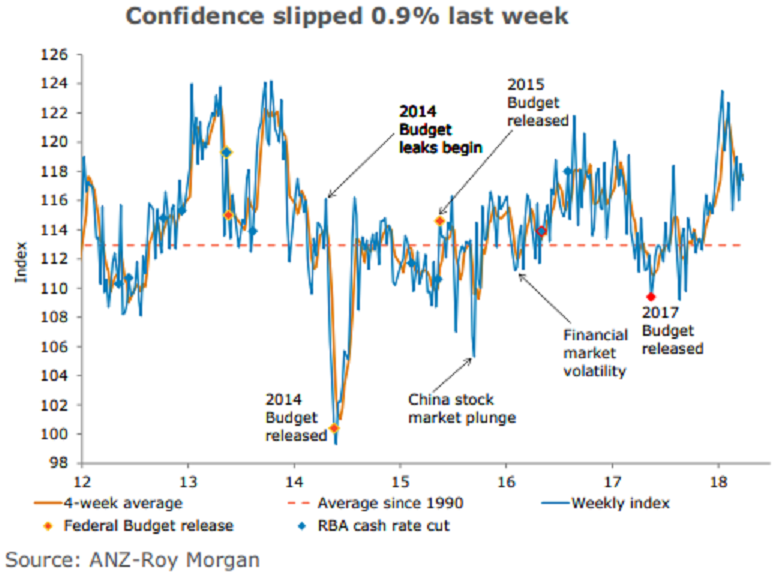

Australia’s ANZ-Roy Morgan consumer confidence slipped 0.9 percent last week following a 2.2 percent bounce previously. The details were mixed, households were more optimistic about future financial conditions and the 'time to buy a household item', but this was more than offset by concern around the economic outlook.

Views towards current economic conditions deteriorated sharply by 6.8 percent to 101.9, its lowest value in 18 weeks. Future economic conditions were also hit, falling 3.6 percent to 108.7, a five-week low. Households’ views towards current financial conditions fell 3.1 percent last week partially unwinding the 6.4 percent rise previously.

Meanwhile, consumers were more optimistic about future financial conditions, which rose 2.8 percent to 130.2 – its highest since February 2017. The 'time to buy a household item' rose 4.2 percent last week to 139.9 – its highest value in eight weeks. Inflation expectations eased to 4.4 percent on a four-week moving average basis, with the latest weekly reading at 4.3 percent.

"Encouragingly, four out of five sub-indices remain above their long-term averages. In particular, after dropping sharply from its February high, the ‘time to buy a household item’ appears to be trending up again. Together with the stabilization of aggregate financial conditions, this may point to some resilience in consumer spending going forward," said Felicity Emmett, Senior Economist, ANZ Research.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns