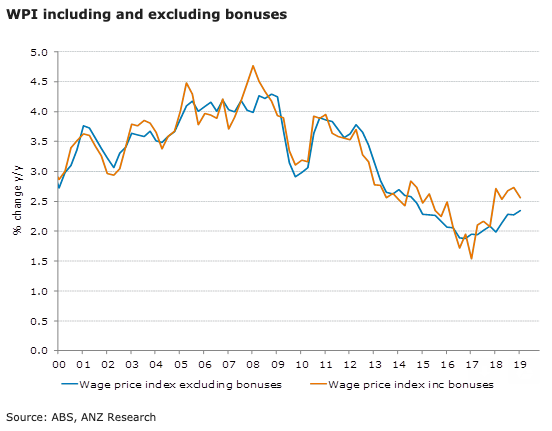

Australia’s annual wage growth steadied at 2.3 percent in Q1 2019. The quarterly result of 0.5 percent was marginally lower than expected but wasn’t far off 0.6% at two decimal places. Annual growth in wages including bonuses slowed from 2.7 percent to 2.6 percent.

It was a tale of two sectors: the public sector recorded its slowest quarterly growth in 19 years, while the private sector saw the strongest annual growth in four years.

The wage price index (WPI) rose by 0.5 percent q/q and 2.3 percent y/y in Q1. The quarterly result was slightly below market and our expectations; however, for the second quarter in a row, it was very close to being 0.6 percent (at 0.54 percent).

Public sector wage growth slowed again to 0.4 percent q/q, the weakest result since 2000, dropping annual growth to 2.4 percent. Private sector wages were steady at 0.5 percent q/q, upping annual growth to 2.4 percent, the strongest result in four years.

Including bonuses, public sector wages slowed to 2.4 percent y/y (from 2.5 percent) and private sector wages slowed to 2.7 percent y/y (from 2.8 percent).

Across industries, construction saw the slowest wage growth, at 1.8 percent (down from 1.9 percent), followed by information media and telecommunications and retail trade. Health care maintained the strongest wage growth at 3.0 percent. Mining (1.8 percent to 2.3 percent) and professional services (2.1 percent to 2.5 percent) improved the most.

New South Wales saw annual wage growth slow from 2.4 percent to 2.3 percent, with growth in South Australia and Tasmania also slowing. The Northern Territory (2.2 percent to 2.4 percent) and the ACT (2.0 percent to 2.1 percent) recorded an acceleration in wage growth. Victoria maintained the strongest wage growth rate nationally of 2.7 percent, while Western Australia remained in the weakest position at 1.6 percent.

"The mixed results do not provide a clear signal to the RBA. Firms are finding it more difficult to source suitable labour, and labour underutilisation rates have declined, but wage growth is picking up at a glacial pace. Labour underutilisation needs to drop faster to generate faster wage growth," ANZ Research commented in its latest report.

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off