Australia’s Capex fell slightly in Q3, although this was somewhat tempered by the upgrade to the Q2 result, from -2.5 percent q/q to -0.9 percent q/q. Further, outside of the weakness in construction, the details of the report were positive.

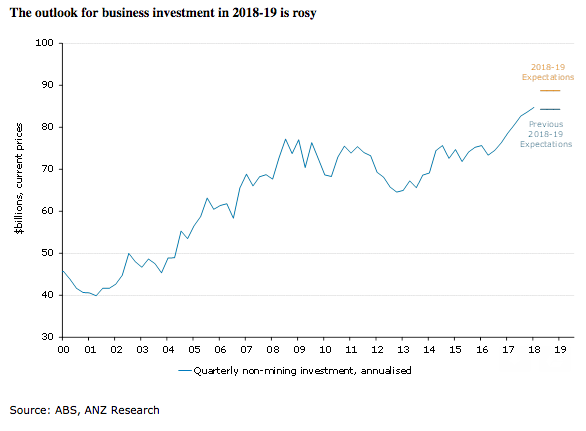

In even better news, the outlook for 2018-19 was revised materially higher. This is important because this release is where firms’ forecasts traditionally become much more accurate.

Non-mining firms now expect their investment to increase 7 percent over the current financial year, which is a much better outcome than the 2 percent growth forecast three months ago.

Even the mining sector is slowly turning around. Gas and oil investment fell a further 8 percent in Q3, likely driven by the Ichthys project fast approaching completion. But iron ore investment rose again, with spending in Q3 more than 50 percent above the Q2 2017 trough.

"Further, mining firms expect investment to fall by just 1 percent in 2018-19, which would be the best result since 2012-13," ANZ Research commented in its latest report.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient